Grahamian Value Week in Review ― April 16, 2021

“The safest and most profitable thing is to buy something when no one likes it. Given time, its popularity, and thus its price, can only go one way: up.”

— Howard Marks (January 24, 1994)

PART ONE.

WEEK IN REVIEW

PART TWO.

“THE ROAD AHEAD FOR NATURAL RESOURCES” (SELECT EXCERPTS)

PART THREE.

WEEKEND WATCHING

PART FOUR.

WEEKEND LISTENING

In the past week —

There have been no changes to our Grahamian Value Classic list.

BRIEF OVERVIEW —

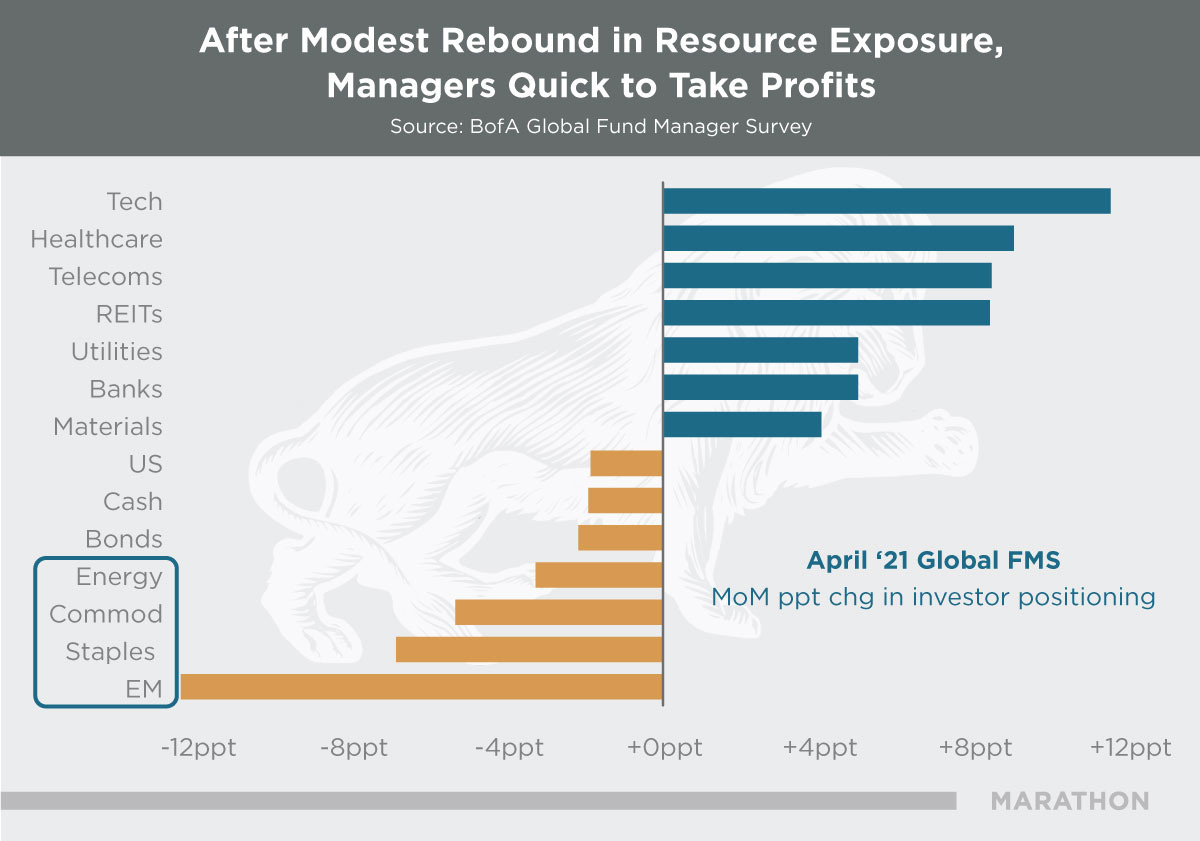

We are intrigued (and impressed) by professional perspectives on the commodities investment landscape shared by Robert Mullin of Marathon Resource Advisors in San Francisco. With full permission, we showcase key excerpts and infographics from his writings.

I. WEEK IN REVIEW

This marks our twenty-seventh consecutive week with no new additions to the Grahamian Value Classic list of companies.

II. SELECT EXCERPTS FROM “THE ROAD AHEAD FOR NATURAL RESOURCES”

“The challenge for capital allocators is that, unlike the physical world, the financial setting is constantly evolving. Usually, this manifests itself in gradual changes over years or even decades, resulting in prolonged periods of relatively consistent investment themes. Periodically, its shifts can be significantly more abrupt, and major turning points are typically marked by extended periods of elevated volatility coupled with a change in market leadership.”

— Robert Mullin, January 2021 (San Francisco, California)

With editorial emphasis added (bold) —

Capital expenditures for public natural resource companies, in spite of the most accommodative broader capital markets in history, have fallen by over 60% since peaking in 2012 to levels not seen since the early 2000s. It is worth noting that over that time frame broad commodity consumption has risen 35%. It is our belief that this growing base of demand is being severely underfunded.

The combination of natural decline rates as well as marginal capacity closures could well mean that the levels of demand needed to do so are below those that prevailed pre-Covid. Should that be the case, we would note that the most durable and powerful commodity bull markets are those built, not on rapidly rising demand, but on structurally constrained supply. We are reminded of the quote from Hall of Fame Basketball Coach Marv Harshman on his preference for tall players over fast ones: “Quick guys get tired. Big guys don’t shrink.”

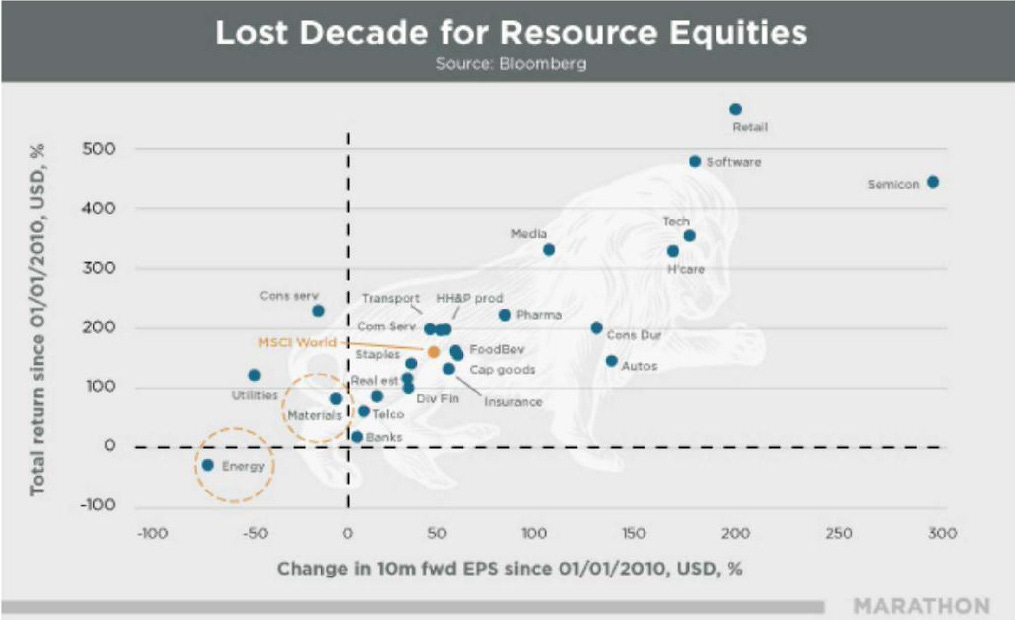

Sundial Research recently noted that the performance of the Energy sector versus the S&P through Q3 2020, calculated using relative performance from 3-year highs, was the single worst showing by any S&P sector since 1928. In our 30+ years of investing, we feel like we have witnessed firsthand some brutal stretches for various sectors, including Tech/Telecom in 2000 and Financials in 2008, yet Energy has somehow managed to outdo not only those two extremes but every other one in the last 90 years… it is not surprising that its weighting in the S&P 500 has fallen by over 85% since 2014.

Norway is the poster child for going green as they are endowed with both prodigious hydropower as well as oil & gas riches to fund their transition. While EV/Hybrid autos now currently account for almost 90% of new car sales there, fossil fuel consumption has not declined measurably in the last 20 years.

Gold equities today are amongst the most profitable businesses in the entire market, with the 40% operating margins noted above roughly double the next most attractive sectors. Much of this cash generation has been channeled towards debt reduction, share buybacks and increasing dividends in a broader market that is going the opposite direction on all three. And yet they currently trade at 50%-80% discounts on a P/E basis.

It is our belief that one of the most attractive ways to express optimism regarding the growth in the green economy is via equities with exposure to large economic deposits of copper, cobalt, nickel, rare earths, silver, platinum, tin and other materials…[many of these companies] remain painted by the “commodity” brush and trade at profoundly cheap multiples. The largest platinum producer in the world, poised to benefit from the assumed exponential growth in hydrogen fuel cell demand, trades at less than 4X 2021 EPS. The world’s largest nickel producer is only modestly more expensive at 7X 2020 EPS, and several base metals royalty companies generate 10%+ free cash yields despite tremendous leverage to demand growth and higher prices for renewable energy inputs. It seems clear to us that either the market will reward these companies as their earnings, cash flows and reserve values accelerate, or the renewable companies will use their richly valued paper to secure access to their bounty via buyouts.

When one considers the combined deflationary impact of unrestricted globalization and relentlessly declining input/commodity prices over the last decade, it becomes clear that even a moderating of these trends would be incrementally inflationary. Should they reverse in force, it would likely bring out an additional effect of expanding inventory holdings, further exacerbating the inflationary impact. We consider these to be the fundamental underpinnings of re-accelerating inflation. While on their own they may lack sufficient force to overcome the powerful demographic and debt headwinds discussed below, other factors at play may well finally tilt the balance to the upside.

... a doubling of commodity prices would lead to earnings, cash flow and book values in the equities to rise anywhere from 2-5x. One can think of this in terms of an average oil company having costs of $40/bbl, so when prices go from $50 to $100 their profits rise from $10/bbl to something more like $30+ after additional taxes, etc. When one takes the next step and doubles the multiple on those higher earnings and cash flows, the end result is a rise of 300% (or much more) in the underlying equities. We must at this point reiterate, this does not get us back to peak relative valuation, or even average. This is the result of simply recovering to the worst levels ever recorded pre-2020. We can think of very few sectors with the ability to rise several fold and still be near the least expensive levels of the last 50-100 years.

III. WEEKEND WATCHING

Courtesy of Amvest Capital: Altius Minerals Corporation directly and indirectly holds diversified royalties and streams which generate revenue from 14 operating mines. These producing royalties are located in Canada and Brazil and provide exposure to copper, zinc, nickel, cobalt, iron ore, potash, thermal (electrical) and metallurgical coal. The portfolio also includes development stage royalties in copper and renewable energy and numerous predevelopment stage royalties covering a wide spectrum of mineral commodities and jurisdictions. Altius also holds a large portfolio of exploration stage projects which it has generated for deal making with industry partners that results in newly created royalties and equity and minority interests. (Recorded March 11, 2021)

February 24, 2017 — Fairfax to Make Strategic Investment in Altius

April 26, 2017 — Altius and Fairfax Close Strategic Investment Transaction

IV. WEEKEND LISTENING

Courtesy of The HC Insider Podcast: In this episode Jeff Currie, Global Head of Commodity Research at Goldman Sachs, walks us through the drivers and consequences of the coming commodity super-cycle. Over the next decade, redistributive policies, energy transition and the search for new sources of old and new economy commodities will drive a macro shift in prices across all verticals. (Uploaded February 17, 2021)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.