Grahamian Value Week in Review ― December 18, 2020

“Billy, this is Chad Bradford. He’s a relief pitcher. He is one of the most undervalued players in baseball. His defect is that he throws funny. Nobody in the big leagues cares about him, because he looks funny… This guy should cost $3 million a year. We can get him for $237,000.”

— Peter Brand (Moneyball [movie], 2011)

PART ONE.

WEEK IN REVIEW

PART TWO.

SITUATIONAL OVERVIEW

PART THREE.

WEEKEND READING

PART FOUR.

WEEKEND WATCHING

PART FIVE.

WEEKEND LISTENING

In the past week —

No new businesses have been added to the list of Grahamian Value companies.

There were interesting developments at three Grahamian Value listed companies.

OVERVIEW —

This marks our tenth consecutive week with no additions to the list of Grahamian Value companies. We’re now beginning to remove businesses from the list as public market capitalization exceeds corporate (unadjusted) net current asset value. A shrinking list of Grahamian Value names is meaningfully different than a stagnant list — a key development noted internally.

I. WEEK IN REVIEW

Corporate Development: Mammoth Energy Services, Inc.

Mammoth Energy announced on December 8, 2020 receipt of additional data from the Federal Emergency Management Agency regarding a longstanding and ongoing business dispute.

Corporate Development: NCS Multistage Holdings, Inc.

NCS Multistage disclosed on a Form 8-K filed December 10, 2020 —

…the agreements entered into by Repeat Precision, LLC (“Repeat Precision”), a controlled joint venture subsidiary of NCS Multistage Holdings, Inc. (the “Company”), in connection with the settlement of Repeat Precision’s claims in the Diamondback Industries, Inc. Chapter 11 bankruptcy became effective and Repeat Precision received the upfront consideration previously disclosed in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020.

Key excerpts from the above referenced Form 10-Q (filed November 5, 2020) —

In October 2020, we entered into an agreement to settle the Award entered into by the District Court, which will be effectuated through a Chapter 11 plan of reorganization that was filed by Diamondback and is currently set for confirmation on November 12, 2020. The agreement terminates if the bankruptcy court does not approve the plan by December 31, 2020. In connection with Repeat Precision releasing Diamondback and Derrek Drury (“Drury”) from the monetary damages in the Award and certain other claims, Repeat Precision expects to receive: (i) an upfront cash payment of approximately $15.5 million, (ii) the transfer of the ‘035 Patent from Diamondback to Repeat Precision, (iii) payments for future sales of certain setting tool sold by Diamondback or its successor as restitution, until $5 million has been paid in total, and (iv) a note from Drury payable in two years in the principal amount of up to $5 million secured by certain properties and other collateral.

The co-editors feel that it is appropriate to privately adjust the net asset value calculation to incorporate this recent development. As noted previously (Grahamian Value Week in Review — November 6, 2020), NCS Multistage reported slightly more than $20.00 per share (post-reverse split) of unadjusted net current asset value as of September 30, 2020 — then comprised of $8.6 million in cash and equivalents, $24.5 million in receivables, $36.5 million in inventory, and $3.2 million in other current assets; less $24.6 million in total liabilities, largely in $3.1 million of payables, $3.59 million of accrued expenses, and non-current, long-term debt and lease obligations of $8.9 million.

Industry Development: P&F Industries, Inc.

P&F’s Form 10-Q for the quarter ending September 30, 2020 includes the following language:

The ongoing grounding by the Federal Aviation Administration of Boeing’s 737 MAX aircraft, and the dramatic reduction in staffing levels across all of Boeing’s facilities due to the COVID pandemic have greatly reduced production activity at Boeing. As long as the 737 MAX is grounded, it will likely continue to have an adverse effect on our revenue.

Subsequent to this filing, the co-editors understand that:

“The Federal Aviation Administration lifted its ban on the Boeing 737 Max”

“In a boost for Boeing, Ryanair orders 75 additional 737 MAX planes”

(Full Disclosure: The co-editors personally own shares in P&F Industries, Inc.)

II. SITUATIONAL OVERVIEW: RUBICON TECHNOLOGY, INC.

Full Disclosure: At the time of publishing, the co-editors of Grahamian Value own shares of Rubicon Technology stock.In the company’s own words —

[Rubicon Technology]… is an advanced materials provider specializing in monocrystalline sapphire products for optical systems and specialty electronic devices… [and] is a specialized pharmacy that provides prescription medications, over-the-counter drugs and vitamins to patients being discharged from skilled nursing facilities and hospitals... [and] is exploring various alternatives… including potentially… acquiring an existing business, establishing a new venture…

If the company is not already “misfit” enough: Rubicon’s backstory includes a corporate saga involving operations in Malaysia, while Yahoo Finance documents a $22 million public equity sporting a -18.8% operating margin and -$0.28 of earnings per share.

Yet, among the Grahamian Value Classic list, Rubicon Technology stands out as uniquely intriguing to the co-editors — for three reasons: a clean net asset value, clear insider incentives, and a compelling situational setup.

i. Clean Net Asset Value —

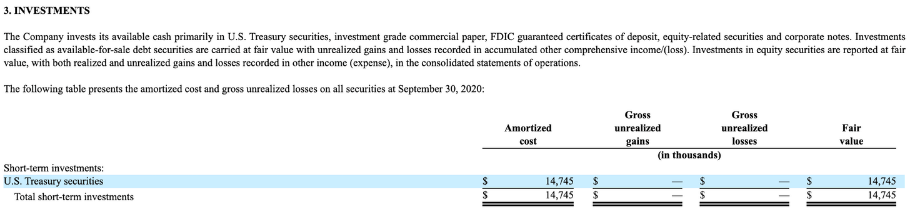

From a pure balance sheet standpoint, Rubicon had a net current asset value of just over $27 million as of September 30, 2020. This was comprised of $10.3 million in cash, $14.7 million in short-term investments, $703,000 in receivables, $1 million in inventories, $1 million in assets held for sale, and about $281,000 in other current assets. Rubicon had $893,000 in total liabilities. Additionally, Rubicon had about $2.5 million in carrying value of property and equipment.

Almost entirely in highly liquid assets, this composition of net asset value is remarkably clean and amounts to slightly more than $11 per share of net current asset value and roughly $12.50 per share of book value, presuming 2.4 million shares outstanding.

As noted in last week’s Grahamian Value Week in Review, Rubicon expects net proceeds of $725,000 from the recent sale of non-core assets.

ii. Clear Insider Incentives —

Timothy Brog joined Rubicon in May 2016 as a board member and was appointed the company’s President and Chief Executive Officer effective March 17, 2017. Prior to Rubicon, Mr. Brog served as Chairman of the Board of Directors of Peerless Systems Corporation from June 2008 to February 2015, Chief Executive Officer from August 2010 to March 2015 and a director beginning in July 2007.

In the co-editors’ view, understanding the incentive structure in place for Mr. Brog at Rubicon is helpful towards assessing the company’s broader roadmap. Rubicon’s latest definitive proxy statement (filed June 15, 2020) reads as follows:

Goal 1: Progress towards an acquisition

The Board wishes to incentivize Mr. Brog to further develop the Company’s acquisition pipeline, with the ultimate goal of finding suitable acquisition targets and eventually closing a transaction. To achieve Goal 1, the Board wants to see material progress from Mr. Brog in improving deal-flow and allocating more time to the search for acquisitions. A signed purchase agreement or the actual consummation of an acquisition would also satisfy Goal 1.

Goal 2: Signed purchase agreements for the Malaysia properties

The Board believes the Company’s assets in Malaysia continue to be an unwanted distraction from Rubicon’s domestic operations. Mr. Brog would achieve Goal 2 by negotiating and signing a purchase agreement for one or both of the Malaysia properties with Board approval. Material progress in finding a buyer for the properties will also be considered by the Board for achieving Goal 2.

Goal 3: 2019 Year-End Cash

Similar to in 2018, the Board wishes to incentivize Mr. Brog in his efforts to preserve capital… The 2019 YE Cash would be adjusted for any unusual items that occur in 2019…

iii. Compelling Situational Setup —

The co-editors are impressed with Mr. Brog’s record of shareholder value creation at Peerless Systems between 2007 and 2014. Also noteworthy, Jeff Gramm (Bandera Partners) owns roughly 10% of Rubicon’s shares outstanding while Michael Zapata (Sententia Capital Management) owns slightly more than 5%.

In the co-editors’ view, both Mr. Gramm and Mr. Zapata are particularly well-versed in corporate governance matters and out of self-interest (for individual-specific reasons beyond the scope of this digest) are deemed likely to respect minority-shareholder interests at Rubicon.

Similar to the Oakland A’s pitcher Chad Bradford mentioned in the opening quotation, Rubicon “looks funny.” A surface level assessment of Rubicon is off-putting (at best) — whereas a more granular exploration could lead to a company singularly focused on creating shareholder wealth, valued at a discount to scrap. While the public equity is unlikely to garner much attention from the more traditional “big league” market participants, language below from a December 16, 2020 press release points to one (well-informed) interested market constituent (emphasis added):

Rubicon Technology, Inc. (“RTI”) had previously implemented a stock repurchase plan to repurchase up to $3 million of its common stock in November 2018. In July 2020, RTI used up all of the remaining amount of such initial $3 million authorization. Today, RTI announced that its Board of Directors has authorized another stock repurchase plan to purchase up to an additional $3 million of its common stock from time to time through open market and private transactions…

“With the sale last week by RTI of its ownership in Rubicon Sapphire Technology (Malaysia) SDN BHD, the liquidation of all of RTI’s material excess assets and the consolidation of our operating facilities, is now complete. In our opinion, shares of Rubicon’s common stock are currently trading at a discount to its intrinsic value and it is a good use of our capital to repurchase our common stock at favorable prices,” said Timothy Brog, Rubicon’s Chief Executive Officer.

Give the gift of Grahamian Value Week in Review this holiday season to a cherished colleague or associate — a perfect digital stocking stuffer for the discerning deep value enthusiast!

III. WEEKEND READING

What are the traits to be a great investor?

Charlie Munger: Obviously you have to know a lot. But partly it’s temperament. Partly it’s deferred gratification. You got to be willing to wait. Good investing requires a weird combination of patience and aggression and not many people have it. It also requires a big amount of self-awareness and how much you know, and how much you don’t know. You have to know the edge of your own competency. And a lot of brilliant people are no good at knowing the edge of their own competency. They think they’re way smarter than they are. And of course, that that’s dangerous and it causes trouble. I think Caltech would have a hard time teaching everybody to be a great investor.

Could [Caltech] help people discover that they have that temperament? Or is this something that you mostly should try on your own?

Charlie Munger: I think you find out whether you’ve got the qualities to win at poker by playing poker… Obviously, it helps to know the basic math of Fermat and Pascal. But everybody with any sense knows that stuff. Having the temperament where Fermat and Pascal are as much as part of you as your ear and nose, that’s a different kind of a person. And I think it’s hard to teach that. I have found — Warren and I have talked about this — in the early days when we talked about our way of doing things, which was working so well, we found some people got it, and they instantly converted to our way and did very well. And some people, no matter how carefully we explained it, and no matter how successful they were, they could never learn — they could never adapt it. They either got it fast or they didn’t get it at all. That’s my experience.

Full transcript of Caltech talk, recorded December 14, 2020; courtesy of Richard Lewis (twitter)

IV. WEEKEND WATCHING

Michael Lewis: “The [Oakland A’s] players are coming out of the showers and they’re all naked I thought, ‘My God, that is a really unattractive group of men.’ The baseball uniform covers up a lot and these guys, they were all fat or misshapen in some way — it was everything, every problem but kind of missing limbs. And I thought if you line those people, those naked bodies up against the wall and ask someone what they do for a living, no one would guess they were professional athletes. The then second-in-command in the front office said, ‘You know, in a funny way, that’s exactly the point. We’re in the business of finding defective players, because if a player doesn’t have something wrong with him, if he’s not defective in some way, the market values him properly and we can’t afford him. What excites me is when I find some player who has some glaring and obvious surface defect — but it actually doesn’t matter to his value as a baseball player.’”

Paul DePodesta: “We tend to focus on physical appearances and in baseball, or in sports, this might seem to make sense. Every scout out there is looking for the six foot three, 205 pound stallion or that Silky Sullivan with the great body who could just do it all. The problem is that that doesn’t always translate into success. Imagine in the decisions you have to make — imagine if you were doing a write up on a company and you met with the CEO and the management team, and you came back and your analysis basically said, ‘Well the CEO seems smart, he’s got a good body on him. I think we should go with this guy.’ It seems ridiculous, right? I got a great statistic from Malcolm Gladwell: ‘3.8% of all adult males are taller than six foot two, 3.8%, and yet 30% of all fortune 500 CEOs are taller than six foot two.’ So, maybe it’s not just the baseball scouts who have this bias…”

V. WEEKEND LISTENING

Courtesy of Invest Like The Best: Sam Hinkie (twitter), founder of Eighty-Seven Capital, joins Patrick O’Shaughnessy (twitter) in long-form conversation. Sam worked for more than a decade in the NBA with the Houston Rockets and then as the President and GM of the Philadelphia 76ers. (December 15, 2020 episode date)

Full show notes and transcript. (direct link)

Sam Hinkie’s resignation letter to 76ers’ ownership. (direct link)

Courtesy of The Business Brew: Tobias Carlisle (twitter), founder and managing director of Acquirers Funds and author of Deep Value, joins Bill Brewster (twitter) of Sullimar Capital Group in sophisticated, long-form conversation. (December 11, 2020 episode date)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.