Grahamian Value Week in Review ― December 11, 2020

“One of the best rules anybody can learn about investing is to do nothing, absolutely nothing, unless there is something to do. Most people — not that I’m better than most people — always have to be playing; they always have to be doing something. They make a big play and say, ‘Boy, am I smart, I just tripled my money.’ Then they rush out and have to do something else with that money. They can’t just sit there and wait for something new to develop.”

— Jim Rogers (Market Wizards, 2012)

PART ONE.

WEEK IN REVIEW

PART TWO.

SHIFTING HOT-ROLLED COIL MARKET CONDITIONS

PART THREE.

WEEKEND WATCHING

PART FOUR.

WEEKEND LISTENING

In the past week —

No new businesses have been added to the list of Grahamian Value companies.

There were interesting developments at four Grahamian Value listed companies.

BRIEF OVERVIEW —

While this is our ninth (!) consecutive week with no material change in the list of Grahamian Value companies, the co-editors note a shifting of market conditions salient to Friedman Industries, Inc. (See important disclosures herein.)

I. WEEK IN REVIEW

Changes in Beneficial Ownership: Dawson Geophysical Co.

Gate City Capital Management, LLC reported a change in their beneficial ownership of Dawson Geophysical Co. on a Form SC 13G/A filed December 10, 2020: the fund owns 1,144,203 shares (4.87% of company) as of the filing, a reduction from 2,463,137 shares (10.58%) reported on April 9, 2020.

Insider Purchase: Friedman Industries, Inc.

Mike J. Taylor, President, CEO and Director of Friedman Industries, Inc., reported his purchase of 10,000 shares in the open market between November 30 and December 2 (at prices ranging from $6.30 to $6.50) on a Form 4 filed on December 2, 2020. Following this purchase, he owns 110,000 shares of Friedman Industries’ stock.

Reverse Stock Split: NCS Multistage Holdings, Inc.

NCS Multistage Holdings, Inc. executed a previously announced a 1-for-20 reverse split (see Week in Review ― November 6, 2020), per a Form 8-K filed on November 30, 2020 —

The Company’s common stock will begin trading on a split-adjusted basis when the market opens on December 1, 2020. The number of authorized shares of NCS common stock has also been reduced from 225,000,000 to 11,250,000.

Asset Sale: Rubicon Technology, Inc.

Rubicon Technology, Inc. expects net proceeds of approximately $725,000 from the sale of a non-core corporate asset, as announced in a Form 8-K filed on December 9, 2020 —

…The sole material asset of the Company that was transferred pursuant to this transaction was the Company’s leasehold interest in land located in Penang, Malaysia that expires on March 15, 2071. [Rubicon] sold the Capital Shares for a gross sales price of $775,000 and it expects its net proceeds from the sale (after the payment of real estate taxes, brokerage and legal fees, transfer taxes and other expenses) to be approximately $725,000.

(Full Disclosure: The co-editors personally own shares in Dawson Geophysical Co., Friedman Industries, Inc., NCS Multistage Holdings, Inc., and Rubicon Technology.)

II. SHIFTING HOT-ROLLED COIL MARKET CONDITIONS

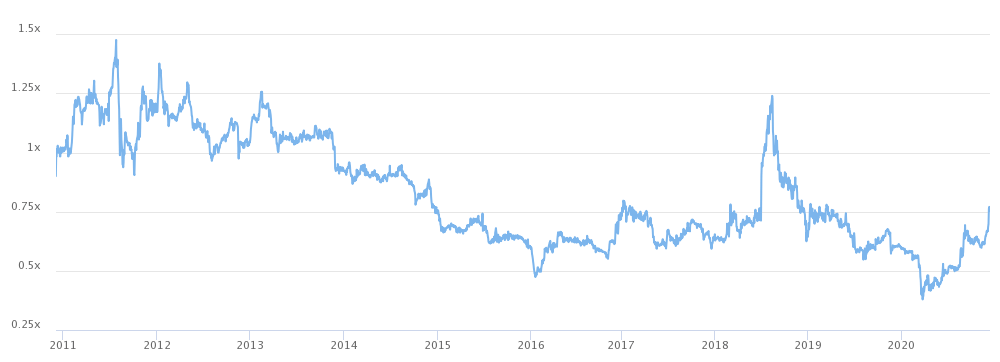

Full Disclosure: At the time of publishing, the co-editors of Grahamian Value own shares of Friedman Industries stock.Friedman Industries, Inc. is a familiar name among (veteran) deep value aficionados. As a “perennial” net-net, the company has a long history of trading below tangible book value, to such an extent that a depressed valuation has proved to be the rule rather than the exception. The periodic windows of “exception” (2011-2014, late 2018) are of particular interest to the co-editors and serve as the basis of the commentary that follows.

Illustration I — Price / Tangible Book Value

Friedman Industries’ returns on capital and assets historically cycle through periodic booms and busts. Historically, the busts have been brutal — with negative gross margins observed in 2016 and 2019. As fortunes turn positive, however, the company has historically generated 20% range returns on capital and 10% range returns on assets, fueled by double-digit gross margins.

Illustration II — Return on Capital (light blue), Return on Assets (dark blue), Gross Margin % (red line)

The variance in Friedman Industries’ historical gross margin (and related historical variance in returns on capital and assets), in the co-editors’ understanding, is largely rooted in the underlying cyclicality of steel pricing itself.

Illustration III — Historical Steel Pricing (Hot Rolled Band)

Informing the co-editors’ viewpoint on the relationship between steel prices and Friedman Industries’ margins is the language below, excerpted from the company’s most recent quarterly report (for the period ended September 30), filed with the Securities and Exchange Commission on November 16, 2020 (with emphasis added) —

During August 2020 hot-rolled steel pricing started to rise and has continued a significant increase of approximately 60% as of the filing date of this Form 10-Q. Our coil segment margins started improving late in the second quarter and have continued to improve during the third quarter. Our tubular segment margins do not respond as quickly to the fluctuations in steel price but we have started to see improved margins for our manufactured pipe sales during November 2020. In general, we expect solid margins for the third quarter. We expect both coil segment and tubular segment sales volumes for the third quarter to be comparable to those of the second quarter with the potential to be slightly less due to typical seasonality associated with the holidays and fewer shipping days.

The above statement appears to disclose that: (1) hot-rolled steel pricing experienced a material change, which in turn; (2) is driving an improvement in Friedman Industries’ operating metrics. While the magnitude of Friedman Industries’ operating metric improvements have yet to be disclosed, the magnitude of steel price change is knowable and relevant.

Illustration IV — U.S. Midwest Domestic Hot-Rolled Coil Steel Index Futures (January 2021)

Additionally salient, and beyond the scope of this electronic digest, are “Note H” and “Note O” within the same regulatory filing (pages 9 and 12, respectively).

The co-editors continue to monitor developments in the pricing of hot-rolled coil; an abridged chronology of recent Fastmarkets AMM dispatches —

Monday, November 23, 2020

“HRC nears $780/t; EAF mill targets $840/t” (Fastmarkets) — Hot-rolled coil prices in the United States have surged on confirmed buying activity and incredibly thin spot availability, prompting at least one electric-arc furnace (EAF) coil producer to quietly communicate a base price increase to customers, Fastmarkets has learned…

Hot band prices have logged a series of steep jumps amid an unparalleled shortage of spot material, with pent-up demand hitting the spot market while major steel-consuming industries continue to recover from the impact of the Covid-19 pandemic. At the same time, there is little threat of imported material arriving in the United States and capping the uptrend…

Quotes of the day

“I do think that the price is still playing catch-up with the spot market. It is definitely tight with the capacity that was idled, and still [is] idled, due to Covid,” a steel consumer said. “Demand is definitely outpacing current production. You would be hard-pressed to get spot tons at anything below $40 [per cwt], so that is what we are basing our costs on.”

“In the short term it’s not about the price, it’s all about access to supply,” a Midwest service center source said. “You thank the mill for availability and don’t question the price.”

“The question becomes how relevant pricing is if availability is so limited and the efficiency of the market is challenged,” a second Midwest service center source said.

“Everybody is worried about the future of pricing,” a Gulf Coast distributor said, describing the current market as a “pretty rare situation.”

Monday, November 30, 2020

“US HRC spot price closes in on $40/cwt” (Fastmarkets) — The price of hot-rolled coil in the United States has reached its highest level in over two years, Fastmarkets has learned…

Hot-rolled coil prices in the United States continued to rise due to a combination of three critical factors: a severely limited supply of spot material, imminent upward pressure forecast for December’s ferrous scrap trade where prices are expected to increase by $30-50 per gross ton, and strong demand from the automotive end market. The dearth of spot material is creating anxiety across manufacturing supply chains, a midwestern service center source said. According to an end user, another electric-arc furnace producer has unofficially raised prices to $42 per cwt with no significant spot tonnage to offer, following increases from Nucor and US Steel last week. Another producer, who recently raised prices, is reportedly unwilling to budge from their new base price.

Quote of the day

“I really believe the very little spot that is available is making everyone feel like the market is much higher than it really is,” a southern service center source said. “Obviously, it will eventually get there if the mills stay disciplined and continue to only offer spot at much higher numbers than where they are transacting 80% of [their contract business].”

Tuesday, December 1, 2020

“HRC surpasses $40/cwt; spot tons elusive” (Fastmarkets) — Hot-rolled coil prices in the United States climbed over $40 per hundredweight ($800 per short ton) for the first time since 2018 after more buyers chased fewer spot tons at the domestic mills…

Sources report that buyers are in dire need of hot-rolled coil, but it is very difficult to find spot availability at the domestic mills for January 2021 shipment. The anticipated increase during the December ferrous scrap trade is another factor in the ascent of the coil pricing. US mills therefore have tremendous leverage to stand firm on higher pricing — and they are doing just that, according to sources…

Quotes of the day

“It’s shortages everywhere,” a midwestern distributor said. No matter the price, “if somebody is willing to sell you steel, you say: ‘Yes, thank you.’”

“I think the mills are creating this shortage and long lead times as they try to recoup for their losses over the past year or so,” a second midwestern distributor said. “Manufacturing is getting busier along with automotive, appliance, etc, but not to the point we are lacking capacity. This is a perfect storm being created without the rain clouds.”

Friday, December 4, 2020

“HRC dashes past $850/ton - $900/ton ahead?” (Fastmarkets) — Hot-rolled coil prices in the United States have shot past $42.50 per hundredweight ($850 per short ton), and there is little on the horizon to stop them from hitting $45 per cwt ($900 per ton) or even $50 per cwt ($1,000 per ton), market participants said…

…Rising prices are supported not only by increasing raw material costs and long lead times but also by higher prices abroad as well as by outages — planned and otherwise — across the North American supply chain. Further support comes from service centers and tube mills that have restocked at current prices and therefore have a vested interest in seeing prices move higher still, sources said. The result: Sources said it is probably only a matter of time before prices hit $45 per cwt, and several said $50 per cwt is a possibility within the next month. US HRC prices have not been at $50 per cwt since September 4, 2008, according to Fastmarkets’ records. That’s more than 12 years ago and shortly before the September 15, 2008, collapse of investment bank Lehman Brothers triggered a financial crisis.

Quote of the day

“It’s no longer trying to get an extra buck or two at a time. They are going to be asking for a heck of a lot of money,” one Gulf Coast steel consumer said. “When spot availability is this tight, the few pounds that they have to sell, they are going to get a really beefy premium for it.”

Tuesday, December 8, 2020

“HRC dips, but mart senses another spike” (Fastmarkets) — Hot-rolled coil prices in the United States continue to hover near their highest levels since August 2018, with buyers preparing for still more increases from the domestic mills…

Lead times are mostly out to late February and early March, with some occasional spot availability still opening up briefly for late January, sources said. The major factor driving current US HRC pricing is limited spot output at domestic mills for at least the next couple of months, while steel-consuming industries are busy and desire material to keep manufacturing lines running. To make matters worse for customers, service centers are caught with flat-rolled inventories that are dreadfully low, sources said. Upstream, raw material costs have jumped, evidenced by ferrous scrap deals that have now seen December settlements move $70-80 per gross ton higher than last month. Some coil buyers said they are bracing for $50-per-cwt domestic hot-rolled prices as early as this month, with scant import tonnage arriving at US docks for the foreseeable future. Buyers further fear not only that an additional price increase might be pending, but also that there could be a historic price crash in 2021 after service centers eventually replenish their inventories.

Quotes of the day

“Two weeks ago we wondered if we would ever reach $45 [per cwt]. Now we believe the next threshold is $50 hot-roll, which may happen by January… I cringe thinking about the summer price crash. It’s not going to be pretty. In the short term, even poorly run mills can make money,” a midwestern distributor source said.

“This is very possibly the worst shape I have seen inventories in at any point in my career,” one HRC consumer source said. “Knowing that, we continue to hear from so many customers that they would like to increase orders in [the first quarter]. Crazy times.”

Wednesday, December 9, 2020

“HRC index reaches nearly 28-month high” (Fastmarkets) — Hot-rolled coil prices in the United States have resumed their uptrend, with buyers on the sidelines waiting for mills to open their order books amid limited material availability, sources told Fastmarkets… Market participants also said there was not much spot activity currently, with buyers waiting for material availability and mills essentially able to name their price for coil.

Quotes of the day

“I think HRC is tight and the spot buyers will pay anything. As a result, that’s increasing the cost for the normal buyers,” a steel distributor said.

A consumer source said: “2020 is definitely not a normal year, there is no calm before the holidays this year... Steel mills are not quoting spot tons until they open up their order books, but when they do the tons are gone quickly.”

Thursday, December 10, 2020

US HRC nears $45/cwt on thin spot activity (Fastmarkets) — Hot-rolled coil prices have surged to their highest point in more than 28 months on thin spot volumes and growing fears of supply shortages, market participants said.. Lead times are averaging eight to 12 weeks — or into March at some mills, market participants said. And other mills have yet to reveal February prices, they added. Current lead times are double or even triple the four to six weeks that characterize a normal market.

…And some sources said spot prices might soon move to or above $50 per cwt — a figure not seen in the market since early September 2008. The problem is that spot volumes remain extremely limited, with some sources struggling to secure as little as two truckloads from domestic mills and others unable to obtain any spot tons at all, or even a price for spot material. The result is that buyers are increasingly worried about a potentially severe supply shortage developing over the next month. Some also noted that steel prices rarely hold above $45-50 per cwt for long and expressed concern that current high prices could unwind quickly, especially given that they are underpinned by very limited spot transaction volumes. What remained unclear on Thursday was when the current cycle will reverse and what might cause it to cycle downward again.

Quote of the day

“I wonder what [spot] tons they are selling... I don’t care about the prices so much as are there tons available or not? And I have not been able to get a straight answer from the mills,” a Midwest service center source said.

Full Disclosure: The co-editors of Grahamian Value own shares of Friedman Industries stock and have made material purchases within the past two weeks.III. WEEKEND WATCHING

Courtesy of PBS39 (Greater Lehigh Valley Public Media): Bethlehem Steel, The People Who Built America is the 2004 recipient of the Edward R. Murrow Award for Best News Documentary and Winner of the Mid-Atlantic Emmy Award for Outstanding Documentary. Bethlehem Steel was a major producer from the 1850s until 1995, making steel for the Golden Gate and George Washington Bridges, as well as for many Manhattan office buildings (more than 85 percent of the skyline at one time, according to some estimates).

Courtesy of Metallurgy Data: Steel manufacturing from start to finish, including blast furnace, steel making (BOS and EAF), secondary steel making, continuous casting and rolling and tube manufacture.

IV. WEEKEND LISTENING

Courtesy of Inside the Rope with David Clark: John Hempton (twitter) comes back onto Inside The Rope to revisit COVID-19 and discuss the things that he believes Bronte Capital miscalculated at the beginning of the pandemic, along with what else they could have done better. He and David also discuss how society measures the risk vs reward benefit of returning to normal activities in light of COVID-19, along with how that is relevant from the perspective of investing in financial markets. John also highlights some of Bronte’s latest investments, which John places all in the “value bucket.” (November 9, 2020 episode date)

Courtesy of Bill Gates and Rashida Jones Ask Big Questions: Ever since the pandemic started, we’ve heard the same refrain: we need to get back to normal. But what does “normal” even mean after such a history-changing event? Bill and Rashida discuss how COVID-19 will forever change our workplaces, our schools, and even our social lives. They also get real with NIAID director Dr. Anthony Fauci about what we can expect in the months ahead. (November 16, 2020 episode date)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.