Grahamian Value Week in Review ― December 25, 2020

“We make a living by what we get. We make a life by what we give.”

— Winston S. Churchill [*]

PART ONE.

WEEK IN REVIEW

PART TWO.

FEATURED GUEST INSIGHT

PART THREE.

HOLIDAY GIFT GIVING

In the past week —

No new businesses have been added to the list of Grahamian Value companies.

There were interesting developments at two Grahamian Value listed companies.

OVERVIEW —

This marks our eleventh consecutive week with no new additions to the Grahamian Value Classic list of companies. Due to underlying share price movement, Universal Stainless & Alloy Products is again trading at a discount to unadjusted net current asset value and therefore has been added back to the list while NCS Multistage no longer meets the valuation requirement.

As noted in last week’s issue, the Grahamian Value list of companies now reflects two distinct categories of equities:

(1) Grahamian Value Classic

As has always been the case, major-index listed American equities trading at a discount to unadjusted net current asset value qualify for list inclusion.

(2) Grahamian Value Select

Grahamian Value Select is a collection of asset-rich companies that fly below the radar of traditional screeners and stock selection techniques. Importantly, the sourcing process of the Grahamian Value Select leans heavily on the triangulation of behavior and portfolio positioning of a select group of Graham-inspired organizations and professionals who the co-editors believe exhibit particular talent, integrity, and aligned incentives.

I. WEEK IN REVIEW

Corporate Development: Rubicon Technology, Inc.

Rubicon Technology, Inc. announced on December 18, 2020 the extension of a Section 382 Rights Agreement to “[protect] against a possible limitation on the Company’s ability to use its net operating loss carry-forwards, which for U.S. federal income tax purposes were estimated at approximately $188.1 million as of December 31, 2019.”

Changes in Beneficial Ownership: Universal Stainless & Alloy Products, Inc.

Privet Fund LP reported a change in their beneficial ownership of Universal Stainless & Alloy Products, Inc. on a Schedule 13D filed December 11, 2020 — the fund owns 586,387 shares (6.64% of company) as of the filing, a reduction from 698,321 shares (7.91%) reported on March 25, 2020. Prior ownership filings: July 17, 2019 reporting 838,457 beneficially owned shares or 9.56% outstanding and June 26, 2019 reporting 729,463 beneficially owned shares or 8.32% outstanding.

(Full Disclosure: The co-editors personally own shares in Rubicon Technology, Inc.)

II. FEATURED GUEST INSIGHT

Important Message for All Readers: The public equity explored below is thinly-traded and not listed on a major exchange. Particular prudence is warranted, personal diligence is always strongly advised.The following is a guest contribution by David J. Flood (twitter), a United Kingdom-based investor and entrepreneur whom the co-editors of Grahamian Value especially admire. David is the co-editor (with Jan Svenda) of Svendamanual.com, an OTC markets focused database highlighting interesting value stocks. Additionally, he is the founder of Elementaryvalue.com, a value-focused investing blog which specializes in looking at net-nets, nano-caps, OTC/Dark stocks and special situations.

ECC Capital Corp. (ECRO) was a failed subprime mortgage REIT that owned a collection of mortgage assets including a subprime book which it sold to Bear Sterns in 2006. After the sale it was left with some equity interests in various securitization trusts, a batch of performing mortgages and some litigation claims against Bear Sterns and ECC Capital Corp.’s former lawyers.

ECC Capital assumed it was free and clear of any repercussions after the sale of the subprime book to Bear Sterns but it turned out that the lawyers had messed up and the firm still had exposure. ECC Capital subsequently won 2 of its 3 litigation claims, one against Bear Sterns in 2009 and one against Latham, one of its lawyers, in 2011. The third suit against Manatt, another of its legal teams, was lost and ECC Capital had to pay out $7 million in 2016.

The last available financials for ECC Capital were from 2008 and then it moved onto the pink-sheets, stopped filing financial reports, and the news flow dried up aside from whatever updates appeared on the company website. The company made a series of cash distributions to shareholders between 2008 and 2011 and then they stopped along with the news updates. The company went dark.

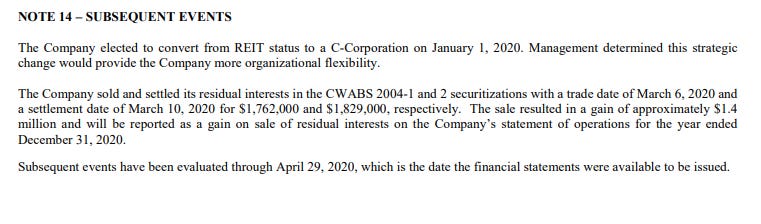

In 2019 ECC Capital ‘de-REIT’ed’ and then in June 2020 the unthinkable happened: ECC Capital put out financials for the first time in over a decade. They revealed the following —

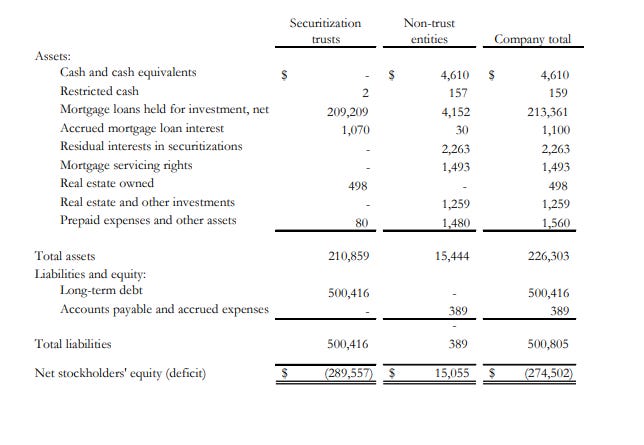

The middle column named ‘Non-trust entities’ is the one we are interested in. It tells us that ECC Capital has net stockholder’s equity of $15,055,000 which includes $4,610,000 in cash and equivalents; total liabilities stand at $389,000. This isn’t the full picture though —

In March 2020, ECC Capital sold its residual interests in the securitization trusts for just under $3.6 million netting a $1.4 million profit on their stated book value of $2.2 million. That means ECC Capital now has a net cash position of $7.8 million and a net book value of $16.4 million. The market capitalization currently stands at $6.6 million, meaning ECC Capital is now trading at 0.85x net cash and 0.4x net book value. Additionally, the company maintains a substantial base of NOLs to offset future taxes. The company’s Chairman and majority shareholder, Steve Holder, recently brought in a new President who is likely to focus on pursuing deals to acquire productive assets and utilize the NOL carry-forwards.

Important: Investors should take note that ECC Capital currently trades on the OTC markets and does not file with the SEC, its shares are thinly traded and its share price is volatile. A longer (and more detailed) version of this writeup is available here.

Full disclosure from the co-editors —

David J. Flood owns shares of ECC Capital Corp. at the time of writing.

As of the time of this writing, the co-editors do not own shares of ECC Capital Corp. Please see important disclaimers at the end of this communication.

III. HOLIDAY GIFT GIVING

In light of the holiday season, the co-editors wish to “give” the gifts of compilations of writings from individuals and organizations whom we hold in high esteem — including Benjamin Graham (of course), Dr. Michael Burry, Berkshire Hathaway, and lastly a four-part Substack issue courtesy of new Grahamian Value team member Kalani Scarrott (more details forthcoming).

Co-Editor: This archive contains letters to shareholders of Graham-Newman Corporation, lectures Graham gave at Columbia Business School, and select other works. Duly noted are Graham’s ever-present focus on intellectual rigor and a scientific, heavily quantitative, approach to markets.

From Page 378: “There is undoubtedly an organic but inverted relationship between the growth stock concept and the theory of undervalued securities. The attraction of growth is like a tidal pull which causes high tides in one area, the assumed growth companies, and low tides in another area, the assumed non-growth companies.”

Co-Editor: While not the most well-known writings of the investment world, I hold a deep appreciation for the periodic letters that Michael Burry sent to investors while running Scion Capital, LLC — and believe that his disregard for the viewpoints of fellow market participants is one that all too often is lacking in this field.

From Page 14: “…most in the market treasure the dollar bill that consistently sells for $1.10 or more — as long as it consistently does so. In short, volatility is on sale because 99+% of the institutions out there are doing their best to avoid it — under the mistaken but Nobel Prize-winning impression that volatility and risk have some relation. Those of us that feel affection for volatility therefore hold title to the most disabused yet undervalued quality that the markets have to offer.”

Co-Editor: Bill shared the link below with me earlier this year and the site is an exceptional “signal to noise” resource of primary source documents for all-things Berkshire Hathaway (plus Blue Chip Stamps, Wesco Financial, and more); delighted to “pay it forward” and hope you similarly enjoy.

Co-Editor: The overnight success (that’s been years in the making) of Curated by Kalani is entirely deserved as the quality speaks for itself; I think you’ll likewise recognize and appreciate the care that’s embedded in Kalani’s work. Below you’ll find the digital gift of his collected insights.

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.