Grahamian Value Week in Review ― February 26, 2021

“I think a lot of funds get their ideas from Wall Street. I just like to find my own ideas. I read a lot. A lot of news. I just follow my nose. A lot of times it's a dead end, but sometimes there’s value there.”

— Michael Burry

PART ONE.

WEEK IN REVIEW

PART TWO.

WEEKEND READING

PART THREE.

WEEKEND WATCHING

PART FOUR.

WEEKEND LISTENING

In appreciation —

We’re thrilled to introduce Ben Bakhshi and Giri Krishnan as new Grahamian Value Project Volunteers. Thank you for your contributions and welcome aboard!

OVERVIEW —

One company returns to our Grahamian Value Classic list.

I. WEEK IN REVIEW

This marks our twentieth consecutive week with no new additions to the Grahamian Value Classic list of companies.

Due to underlying share price movement Rubicon Technology, Inc. (again) qualifies for inclusion on the Grahamian Value Classic list; see our December 18, 2020 update for additional background.

II. WE’RE IN GOOD COMPANY

Michael Burry owns 1,500,000 shares of NOW Inc., purchased sometime in the quarter ended December 31, 2020 — as disclosed by filings with the Securities and Exchange Commission on February 16, 2021.

While we lack visibility into Michael Burry’s underlying cost basis, we note the market capitalization of NOW Inc. dropped below the company’s net current asset value during this reporting period; relatedly, the business appeared on our Grahamian Value Classic list.

The weakness of net-nets as an actionable asset class is an inability to scale for large sums of capital — or arguably, therein lays the strength. Net-net opportunities that are both large and liquid arise (or, more accurately, collapse) from time to time, generally within a context of “localized decimation.”

As excerpted from Grahamian Value Week in Review ― October 2, 2020:

Oil and gas markets are incredibly distressed, driving a dislocation in sector market valuations. NOW Inc.’s market capitalization peaked in 2014 at roughly $4 billion and has since declined by more than 85%; with roughly 110 million shares outstanding, NOW Inc.’s present market capitalization is just under $500 million [roughly $4.50 per share].

…balance sheet (unadjusted) net current assets [at the time] totaled approximately $559 million [slightly above $5.00 per share]: $269 million of cash and cash equivalents, plus $242 million of net receivables, plus $370 million of net inventories, less $166 million of accounts payables, less $104 million in accrued expenses, and less $52 million in assorted other liabilities — with no long-term debt.

We (very conservatively) estimate that in excess of $30 million worth of NOW Inc. shares transacted at or below net-net valuation levels.

Michael Burry’s involvement in the above company from our Grahamian Value Classic list compels us to further explore Scion’s other reported holdings, particularly those outside the United States, for additional public equities with intriguing attributes.

On September 4, 2019, Bloomberg reported that Scion Asset Management had taken “major stakes” in a number of Japanese enterprises. Dr. Burry explained to Bloomberg, via an email interview:

“In many cases, the company might have significant cash or stock holdings that make up a lot of the stock price... I want to see evidence that the company is investing to grow the business, buying back stock, paying dividends, or making accretive acquisitions.”

Enunciating the reasoning behind several of his Japanese investments, we list the following point-in-time comments by Dr. Burry (arranged in alphabetical order) —

Altech Corp. — The company “will benefit from recent immigration reforms as it expands into agriculture and patient care areas.”

Kanamoto Co. — “They run a tight ship from a credit perspective, and maintain their equipment for high resale at auction. They also look to acquire both equipment and whole companies opportunistically, and there is a lot of room for consolidation in Japan.”

Murakami Corp. — Burry pointed out that Murakami has cash of about 28 billion yen and stock holdings of about 2.5 billion yen, with a market value of 29.3 billion yen. “Situations like that call for more dramatic action, and I’d like to see large tender offers for 1/3 or more of the shares, large special dividends. I just have not seen that, and there is a long way to go.”

Nippon Pillar Packing Co. — “with a high beta to the sector as the inventory of tech components is finished off and growth resumes.”

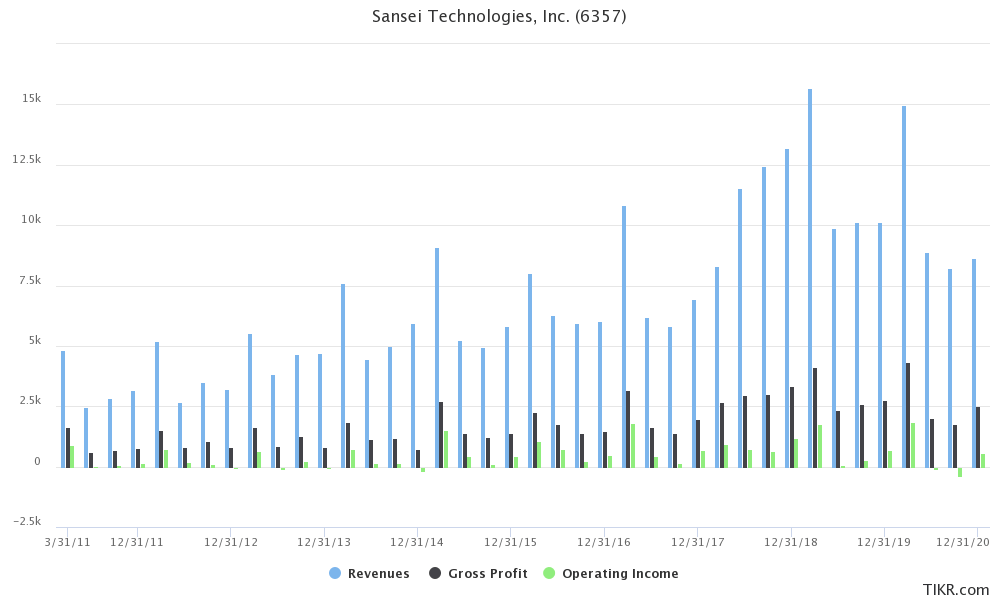

Sansei Technologies Inc. — [The company] “should pay down debt to improve cash flow and to put it in position for another acquisition.”

Tazmo Co. — [The company] “needs to invest in its business to develop the potential of the markets it serves.”

Tosei Corp. — Burry sees the company as an “opportunistic player in urban real estate.” He said he likes the management team, considers the stock to be cheap at about 7 times earnings and said they have been opportunistic with share buybacks. “It is one of my larger positions because they are executing in every facet of the business, including capital allocation.”

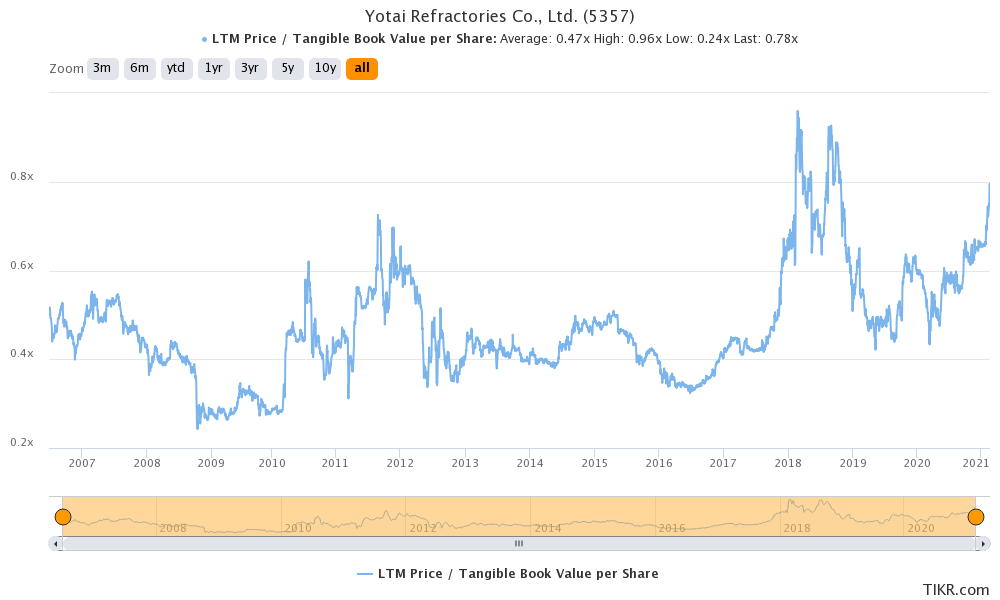

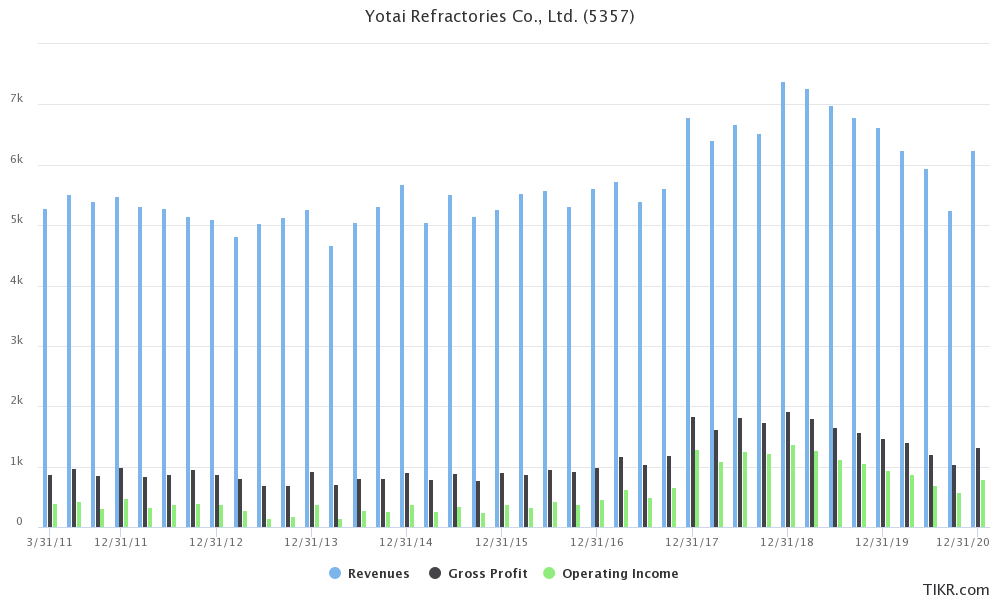

Yotai Refractories Co. — The company had 4.4 billion yen in cash and equivalents at the end of March. It has a market value of 13.4 billion yen.

Bloomberg’s Reed Stevenson spoke again with Dr. Burry on March 15, 2020. Addressing, in his view, why “this time is different” regarding Japan, Dr. Burry noted:

“Japan has had many false dawns yes, but the current recession and stock sell-off is clearly due to temporary external factors... This means that M&A in Japan should pick up, and yes, management is often open to this — especially in cases where the succession plan is not clear. This is a big change from my experience with management 15 years ago.”

Several factors at play seem to back up this thesis, as noted by Bloomberg:

This year [2020], Japan has seen a flurry of hostile takeover bids and moves by activist shareholders, fueling optimism they might finally shake loose cash and assets locked in the coffers of Japanese firms. Kirin Holdings Co. is being pushed by London-based Independent Franchise Partners to sell its wellness and pharmaceutical businesses, while Elliott Management Corp. has taken on SoftBank Group Corp., arguing the technology investment company should buy back shares and improve corporate governance.

“I find there is a trend here,” Burry said, adding “the basic direction is a good one.”

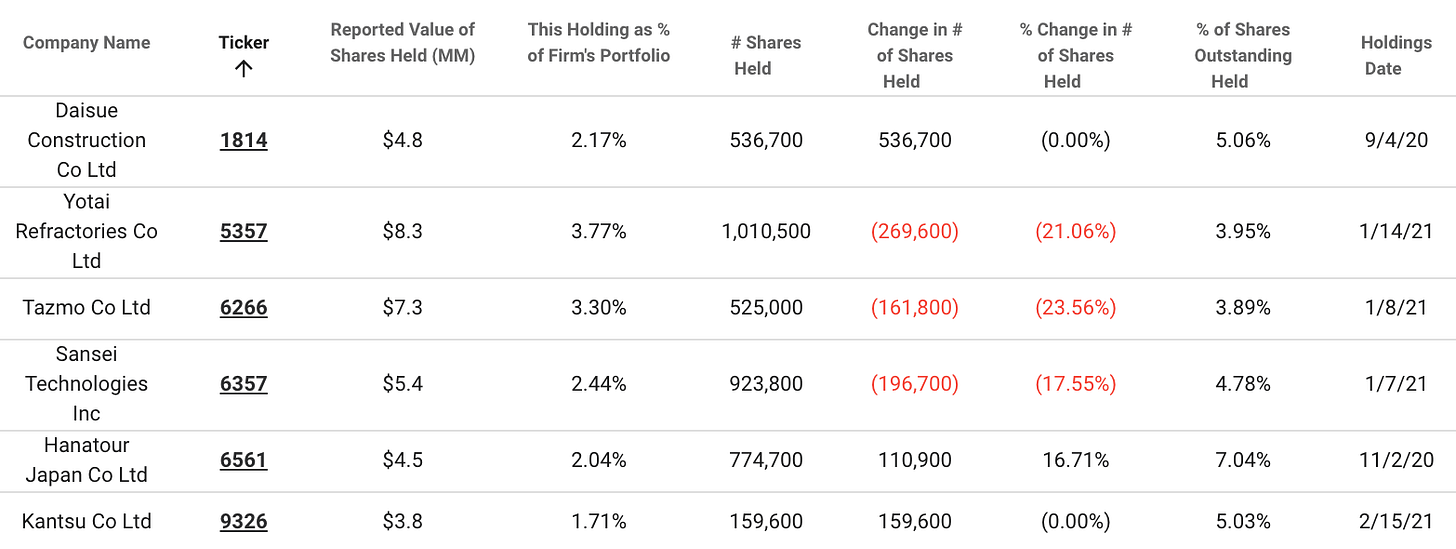

The table below summarizes Scion Asset Management’s current Japanese investments, as sourced from TIKR.com (which we wholeheartedly recommend!) —

From the Grahamian Value Team: We briefly explore Daisue Construction Co., Ltd. (1814), Sansei Technologies, Inc. (6357) and Yotai Refractories Co., Ltd. (5357), respectively. Hanatour Japan Co., Ltd. (6561), Kantsu Co., Ltd. (9326) and Tazmo Co., Ltd. (6266) each trade at meaningful premiums to tangible book and are best understood through a prism beyond the purview of this digest.

Daisue Construction Co., Ltd. (1814) —

Sansei Technologies, Inc. (6357) —

Yotai Refractories Co., Ltd. (5357) —

…to be continued.

III. WEEKEND WATCHING

Courtesy of UCLA: 2012 UCLA Department of Economics Commencement featuring Dr. Michael J. Burry as keynote speaker. (Uploaded June 20, 2012)

IV. WEEKEND LISTENING

Courtesy of Bloomberg’s Odd Lots, hosted by Joe Weisenthal and Tracy Alloway: Questions continue to arise over the effect of passive investing, and whether or not it’s somehow distorting the market. On this week's episode, we speak to Vincent Deluard, the Director of Global Macro for INTL FCStone Inc., who argues that the endless bid for ETFs have helped fuel a bubble in mega-cap stocks, which continue to outperform the market. (March 9, 2020 episode date)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.