Grahamian Value Week in Review ― November 20, 2020

“We’ve survived this [pandemic] because of enormous fiscal and monetary stimulus, and I’ve got to believe this will lead to devaluation of currencies, that hard assets ... will increase in value in currency terms."

— John Malone (November 19, 2020)

PART ONE.

WEEK IN REVIEW

PART TWO.

WEEKEND WATCHING

PART THREE.

WEEKEND LISTENING

In the past week —

No new businesses have been added to the list of Grahamian Value companies; Servotronics, Inc. (Week in Review ― September 25, 2020) is back on the list.

We’ve noticed interesting developments at four Grahamian Value listed companies.

BRIEF OVERVIEW —

We continue to review quarterly financial results and assorted SEC filings.

I. WEEK IN REVIEW

Updated Financials: Friedman Industries, Inc.

Friedman Industries (Longform ― August 17, 2020) reported a gross margin of 4.39% for the quarterly period ended September 30, 2020 — compared to 1.09% for the quarterly period ended June 30, 2020, and negative 1.96% for the quarterly period ended September 30, 2019.

Net current asset value (unadjusted) as of September 30, 2020 totaled about $50 million (slightly above $7 per share) comprised of $18.8 million in cash and equivalents, $11.3 million in accounts receivable, $26.5 million of inventory, and $1.9 million of other current assets; less $7.8 million of total liabilities, largely in short-term payables, and including a $1.7 million PPP loan.

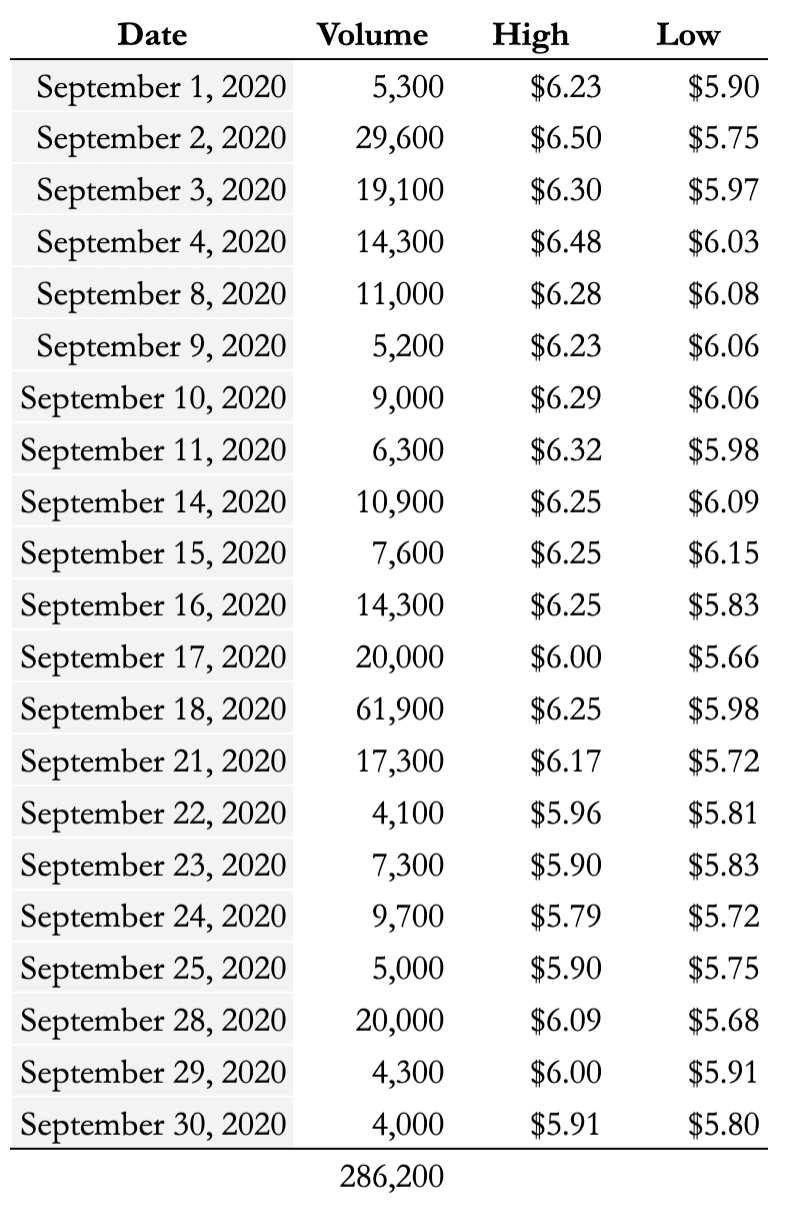

Friedman Industry’s board authorized a share repurchase program of up to 1,062,067 shares (15% of outstanding) on June 25, 2020; the company repurchased 67,391 shares during quarter ended September 30, 2020 —

Further: Form 10-Q, filed November 16, 2020

Notably, the company repurchased one of every five shares that traded during the month of September —

Updated Financials: Rubicon Technology, Inc.

Rubicon Technology (Week in Review — September 18, 2020) reported a net loss of $196,000 and roughly broke even on a cash flow basis for the quarterly period ended September 30, 2020.

Net current asset value (unadjusted) totaled about $27 million (just over $11 per share) comprised of $10.3 million in cash, $14.8 million in short-term investments, $703,000 in receivables, $1.2 million of inventory, $1 million of assets held for sale (primarily real estate) and $142,000 of other current assets; less $893,000 of total liabilities, all of which are current.

The company’s Direct Dose Rx business unit launched in May 2019 continues to scale. Direct Dose Rx is a specialized pharmacy that provides prescription medications, over-the-counter drugs and vitamins to patients being discharged from skilled nursing facilities and hospitals and directly to retail customers who want such medications delivered to their home. The delivered products are sorted by the dose, date and time to be taken and come in easy to use perforated strip-packaging as opposed to separate pill bottles —

Management remains focused on strategic acquisition(s) —

In addition to our current optical and industrial sapphire business and our Direct Dose Rx existing business, we are actively evaluating the acquisition of profitable companies outside of these markets to utilize our substantial NOL [net operating loss] carry-forwards.

Finally, we note that Rubicon repurchased 66,168 shares in the open market during the month of July 2020, which used up the remaining balance of the company’s November 19, 2018 share repurchase authorization —

Further: Form 10-Q, filed November 13, 2020 (Management’s Discussion and Analysis)

Updated Financials: Servotronics, Inc.

For the quarterly period ended September 30, 2020, Servotronics earned just over $1 million in GAAP net income and generated about $0.5 million in free cash flow.

Net current asset value (unadjusted) totaled $22 million (slightly above $9 per share) comprised of $7.5 million in cash, $6.8 million in receivables, $25 million of inventory, and $1.4 million in other current assets; less $18.9 million in total liabilities, $4 million of which is a PPP loan.

Further: Form 10-Q filed November 13, 2020 (Management’s Discussion and Analysis)

Changes in Beneficial Ownership: Universal Stainless & Alloy Products, Inc.

Privet Fund LP reported a change in their beneficial ownership of Universal Stainless & Alloy Products (Week in Review — October 2, 2020) on a Form SC 13D/A filed November 13, 2020: the fund owns 698,321 shares (7.9% of company) as of the filing, a reduction from 838,457 shares (9.5%) reported on July 22, 2019.

(Full Disclosure: the co-editors are personal shareholders in Friedman Industries, Inc., Rubicon Technology and Universal Stainless & Alloy Products, Inc.)

II. WEEKEND WATCHING

Courtesy of CNBC: David Faber sits down with John Malone at Liberty Media’s 2019 investor day. (Recorded November 21, 2019)

Courtesy of CNBC: David Faber sits down with John Malone at Liberty Media's 2018 investor day. (Recorded November 14, 2018)

Courtesy of CNBC: David Faber sits down with John Malone at Liberty Media's 2017 investor day. (Recorded November 16, 2017)

Courtesy of CNBC: David Faber sits down with John Malone at Liberty Media's 2016 investor day. (Recorded November 10, 2016)

Courtesy of The Cable Center (twitter): The Cable Center was honored to welcome Dr. John Malone, Chairman of Liberty Media Corporation and Liberty Global, Inc., as the final speaker of its 2012 Cable Mavericks spring lineup. Dr. Malone conducted a spirited question and answer session with graduate students enrolled in the University of Denver's Daniels School of Business Strategic Finance. (Recorded May 7, 2012)

Courtesy of The Cable Center (twitter): In conversation with Trygve Myhren, an oral history from John Malone. (Recorded October 22, 2001)

III. WEEKEND LISTENING

Courtesy of Grant’s Current Yield Podcast, hosted by Jim Grant (twitter): Will Thompson of Massif Capital shares his refreshingly rational viewpoint on ESG investing — centered around “a more impactful way for investors to facilitate a low-carbon transition would be to selectively invest in companies within these industries, allocating capital toward those companies that are either adapting their activities to a changing landscape or have clearly laid out plans for adaptation and avoiding or shorting the companies that are not.” (November 2, 2020 episode date)

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.