Grahamian Value Week in Review ― October 2, 2020

“Generally, the greater the stigma or revulsion, the better the bargain.”

― Seth Klarman

PART ONE.

WEEK IN REVIEW

PART TWO.

WEEKEND READING

In the past week —

One new business has been added to the Grahamian Value list of companies.

We’ve observed notable developments at three Grahamian Value listed companies.

I. WEEK IN REVIEW

NOW Inc. is a fresh addition to the Grahamian Value Classic list —

NOW Inc. is one of the largest distributors to energy and industrial markets on a worldwide basis, with a legacy of over 150 years. NOW Inc. operates primarily under the DistributionNOW and DNOW brands. Through its network of approximately 220 locations and 3,150 employees worldwide, NOW Inc. offers a comprehensive line of products and solutions for the upstream, midstream and downstream energy and industrial sectors. Our locations provide products and solutions to exploration and production companies, energy transportation companies, refineries, chemical companies, utilities, manufacturers and engineering and construction companies. (source)

Oil and gas markets are incredibly distressed, driving a dislocation in sector market valuations. Now Inc.’s market capitalization peaked in 2014 at roughly $4 billion and has since declined by more than 85%; with roughly 110 million shares outstanding, Now Inc.’s present market capitalization is just under $500 million.

As detailed in the company’s Second Quarter 2020 Investor Presentation and most recent 10-Q, balance sheet (unadjusted) net current assets as of June 30 totaled approximately $559 million: $269 million of cash and cash equivalents, plus $242 million of net receivables, plus $370 million of net inventories, less $166 million of accounts payables, less $104 million in accrued expenses, and less $52 million in assorted other liabilities — with no long-term debt.

As self-described, from the 10-K:

We are a global distributor to the oil and gas and industrial markets with a legacy of over 150 years. We operate primarily under the DistributionNOW and DNOW brands. Through our network of approximately 245 locations and approximately 4,400 employees worldwide, we stock and sell a comprehensive offering of energy products as well as a selection of products for industrial applications…

We stock or sell more than 300,000 stock keeping units (“SKUs”) through our branch network. Our supplier network consists of thousands of vendors in approximately 40 countries. From our operations in over 20 countries, we sell to customers operating in approximately 80 countries…

As customers increasingly aggregate purchases to improve efficiency and reduce costs, they partner with large distributors who can meet their needs for products in multiple locations around the world. We believe we could benefit from consolidation among the companies we serve, as the larger resulting companies look to global distributors as their source for products and related solutions.

No single customer represents more than 10% of our revenue.

The above operations, at present quotations, are valued at roughly 0.12x EV / Revenues — implying a compelling forward earnings multiple if one is comfortable making non-heroic assumptions on full-cycle, normalized EBIT margins.

In June 2, the company announced that their CFO would be promoted to CEO:

On June 1, 2020, the Board of Directors (the “Board”) of the Company announced that it had appointed Mr. Cherechinsky, the Company’s Senior Vice President and Chief Financial Officer, to serve as the Company’s President and Chief Executive Officer, replacing Mr. Alario who was serving as Interim Chief Executive Officer, effective immediately. Mr. Cherechinsky was also appointed as a member of the Board.

Also, noteworthy:

…Mr. Cherechinsky previously served as the Company’s Vice President, Corporate Controller and Chief Accounting Officer from February 2014 until February 2018. Mr. Cherechinsky served as Vice President—Finance for National Oilwell Varco’s distribution business group from 2003, and as Vice President—Finance for National Oilwell Varco’s Distribution & Transmission business segment from 2011, until the Company’s spin-off in May 2014.

This corporate focus on accounting and finance experience (rather than operational background) for the CEO role is an interesting nuance which we believe is worthy of further exploration.

Update: Dawson Geophysical Company

Dawson Geophysical Co. filed a Form 8-K on November 30 disclosing that their $15 million line of credit has been extended for another year (on the same terms) —

Concurrently, CEO Stephen Jumper asked for (and received) a pay cut —

It’s not every day that one observes a CEO embrace a pay cut, let alone ask for one himself, when the company could easily pay it. Especially with the renewed line of credit, Dawson has more than enough liquidity to support a constant (or even an expanded) salary for Mr. Jumper. All of this, from our vantage point, suggests alignment towards long-term shareholder value (Mr. Jumper personally owns 245,316 shares) and a personal commitment towards the company’s financial strength.

Should the industry-at-large (and/or Dawson, itself) experience deeper market value dislocation, the untapped line of credit allows for interesting optionality.

Grahamian Value readers may notice that the co-editors seem to have a peculiar fascination with Dawson Geophysical (see: September 18 and September 25) — a fact that we happily acknowledge. We hope, in due time, to share with you further news in this regard.

Update: Universal Stainless & Alloy Products, Inc.

We’ve noticed a flurry of recent SEC filing activity at Universal Stainless & Alloy Products, including a number of security registrations, amendments, and terminations.

Most notably, a poison pill was put into place, announced via a Form 8-K filed on August 24, 2020 and registered via a Form 8-A12B, filed the same day —

As with all companies, we believe it’s important to examine insider incentives. All four independent directors received a grant of 1,250 stock options with a strike price of $6.41 per share, with expirations set to August 31, 2030 that become exercisable (in annual installments) over the next three years.

SEC Form 4 for Udi Toledano, filed September 1, 2020.

SEC Form 4 for Christopher Ayers, filed September 1, 2020.

SEC Form 4 for Judith Bacchus, filed September 1, 2020.

SEC Form 4 for David Kornblatt, filed September 1, 2020.

Udi Toledano, Chris Ayers, and Dave Kornblatt have ties to Alleghany Capital Corp., and all directors hold varying amounts of Universal Stainless & Alloy Products stock, ranging from 7,070 shares in the case of Judith Bacchus, up to 71,524 owned by Udi Toledano. They additionally receive cash and stock compensation as disclosed in the proxy statement filed March 26, 2020 —

We’re intrigued (and impressed) by the situational overview published by Nothing But Net-Nets on September 2:

Mark Twain said, “History doesn’t repeat itself, but it often rhymes.” In the case of Universal Stainless, a Pennsylvania-based steel company, history has rhymed four times in the past twenty years. During each of those times, Universal Stainless’s stock, after a stupendous rise, crashed by at least 70%.

Mohnish Pabrai owned it during one of those interludes, from 2002-2006. He wrote a case study about it in his great book, The Dhandho Investor.

In the book, Mohnish discusses why he purchased the stock for about $14 or $15 per share in 2002. At that point, the company had recently purchased its Dunkirk facility for peanuts. The company was losing money and its end markets of aerospace, heavy machinery, and oil & gas, were weak. But the company was employing a “Dhandho” philosophy: i.e., they were making smart moves that cost little, but had optionality for huge upside…

Fifteen years later, with a different CEO and a few crises later, Universal Stainless is down again.

(Read the full piece here.)

The Dhandho Investor by Mohnish Pabrai (twitter) is indeed a terrific read and pages 157 to 165 are especially salient, highlights shared below:

Universal Stainless & Alloy Products, Inc. (USAP) was founded in 1994. Since its inception, it has focused on manufacturing specialty steel products used in niche applications like power generation, aerospace, and heavy equipment manufacturing. The company has three manufacturing facilities. All three plants were mothballed facilities and were acquired by the company for next to nothing. The company spent a total of $10 million to acquire the three facilities. Over the years [as of 2007], it has spent a total of $68 million in capital expenditures to enhance them.

I was attracted to the business right after they acquired their third facility in Dunkirk, New York. All three facilities had some common characteristics when acquired:

There were flexible labor agreements.

There were no legacy costs (pensions / heath care) or environmental liabilities.

Acquisition price was zero or pretty close to it.

Dunkirk was bought for $4 million, but it included inventory and excess assets worth $4 million. In addition. Universal Stainless only paid $1 million in cash and the rest in the form of a 10-year note bearing 5 percent interest. The company effectively got the plant for free. Prior to the Dunkirk acquisition, the company had earned $1.26 per share in 2001 and had a (severely understated) tangible book value of $9.28 per share.

...[The] Dhandho approach [of Mac McAninch, former Chairman/CEO] to buying mothballed steel mills for pennies on the dollar reminded me of our hero Lakshmi Mittal. As we saw in Chapter 4 (“Mittal Dhandho”), Mittal ended up one of the wealthiest men in the world with the same scruffy Dhandho approach to acquisitions — get them for nothing or next to nothing. Mac and Mittal must have some commonality in their ancestral gene pool. Mac’s Dhandho ways further seduced me to load up on USAP. With the Dunkirk acquisition. Universal Stainless could easily earn around $2.75 to $3.75 per share in a few years. Such a business, even with no excess capital was likely worth well over $30 per share…

The negatives were that this was still the steel business. It was cyclical and subject to all the gyrating vagaries of supply and demand. In addition, Dunkirk would require some capital to get it operational again, and they would lose money until it got to at least $25 to $30 million in annual sales. Earnings of USAP were likely to go down in the near future before rising eventually.

In aggregate, I considered it a bet very much worth making. Pabrai Funds first invested in Universal Stainless stock in April 2002. We bought our initial stake in the $14 to $15 per share range — putting 10 percent of assets under management into USAP. How could I miss on this sure shot?

Fast forward a year. The stock is trading at $5 per share — down some 60+ percent from our buy price (ouch!). The company was losing about $2 to $3 million on an annualized basis. Dunkirk was responsible for virtually all of the losses. It was operating at a run-rate of just $20 million a year. The bottom had fallen out of the power generation and aerospace markets and USAP’s other plants were barely breaking even on reduced sales. Excluding Dunkirk, the company’s annualized revenue run-rate was just $40 million — down from over $70 million a year ago. What was I supposed do? Buy more, sell or hold? Clearly the lion had roared loudly.

At this point, we were deeply inside the chakravyuh, and the enemy appeared to be winning and closing in on us for the kill. To survive (let alone emerge victorious), we have to stay calm and follow the chakravyuh’s ring traversal algorithm.

The answer, based on the algorithm, was self-evident. The entire steel industry was in the doldrums. This wasn’t a USAP-specific problem; it was an industry-wide downturn. Intrinsic value was very murky at this time — pretty much indeterminate. Given the cyclical nature of the business, the odds were decent that things might get better as demand came back. We had a significant unrealized loss, less than two years had passed, and intrinsic value was tough to figure out. These are classic signs of being engaged in a furious battle in the heart of the chakravyuh. To have a shot at coming out alive, the answer was obvious — do nothing. Just hold. As my mom always said, “Time is the best healer!”

…In early 2005, USAP’s stock crossed $15 per share. Finally, after a very tough battle spanning nearly three years, we were in positive territory. Now we had a few good choices ahead of us:

Sell at a small profit.

Buy more.

Do nothing.

…In May 2005, the company decided to spend $2.5 million in capital expenditures to install a sixth vacuum arc re-melt furnace. I have a vague idea (at best) of what such a furnace is. What I did understand from Mac on a conference call is that it would raise EPS by about $0.50 per share annually (wow!), and he’d have the furnace paid for in well under a year. Any time a business spends $2.5 million on an asset and will earn $3+ million from that expenditure in the first year alone, you do not need Excel to figure out how awesome that is for shareholders in enhancing intrinsic value.

…As I write this [in 2007], we’ve unloaded about 60 percent of our USAP holdings at an average gain of over 100 percent, and the remaining shares will be sold as the price rises to at least 90 percent of USAP’s conservative intrinsic value. Some of the USAP shares were held for around four years, yielding an annualized gain of approximately 19 percent. Others were held for just a year and the annualized gain was 100 percent. All in all, it wasn’t a home run, but a very acceptable result.

…When the stock was at $5 in 2003, all Pabrai Funds hoped to accomplish after two to three years was simply break-even or hopefully exit with a small loss. The “holding losers for at least two to three years” rule prohibited a sale at that point of maximum pessimism for USAP. The chakravyuh traversal rules helped transform USAP from an ill-timed, ill-fated losing investment into one that has delivered a very acceptable return on invested capital.

Universal Stainless & Alloy Products certainly has a lot to untangle, and we welcome dialogue with our readers. If you feel you know the situation well, please send us an email at grahamianvalue@gmail.com

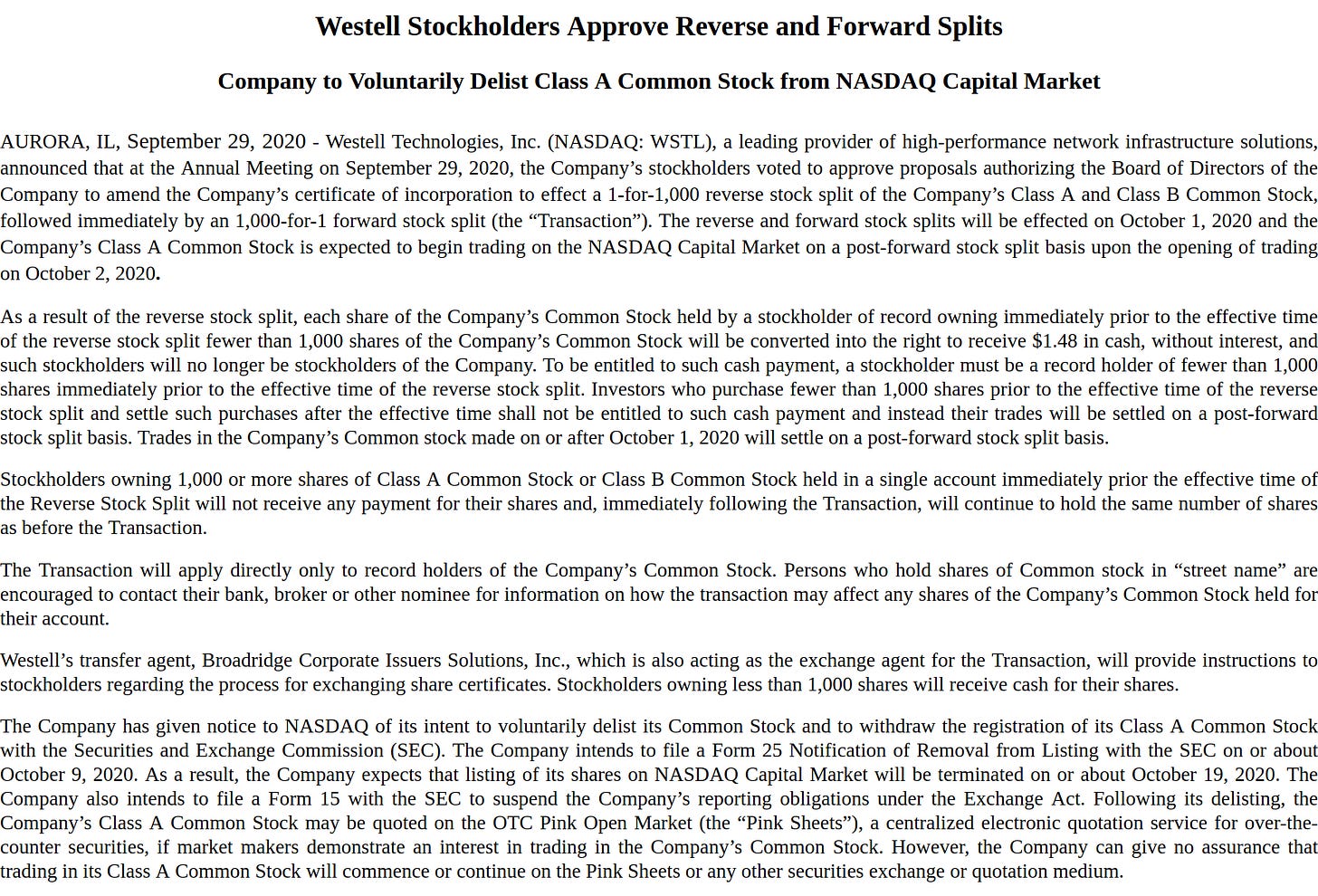

Update: Westell Technologies, Inc.

Following up on last week’s review, Westell Technologies held its annual meeting of stockholders on Tuesday, September 29. As expected, Westell stockholders approved the reverse and forward stock splits and subsequent delisting, paying cash in lieu of fractional shares —

Exhibit 99.1 of SEC Form 8-K filed September 29, 2020.

(Full Disclosure: the co-editors are personal shareholders in Dawson Geophysical Co., Now Inc., Universal Stainless & Alloy Products, Inc., and Westell Technologies, Inc.)

II. WEEKEND READING

We are fascinated by the remarkable story of the Chandler brothers and encourage readers of Grahamian Value to explore “Secrets of Sovereign,” published in Institutional Investor on March 16, 2006, in its entirety.

“In two decades Richard and Christopher Chandler’s bold bets transformed a $10 million family fortune into a cool $5 billion. In an exclusive interview, Richard Chandler discusses his passion for business ethics, his penchant for unorthodox metrics and his new focus on Asia.”

Excerpt I:

…the Chandlers prefer to operate at a distance from the crowd, steering clear of consensus views. One of Richard’s favorite sayings comes from legendary value investor and Pioneer Investments founder Philip Carret, who said it is essential to “seek facts diligently, advice never.” Explains Richard: “Money managers have to account for their actions to their shareholders, which means they have an undue fear of underperformance. We invest only our own money. Our investment decisions are driven by optimism, not fear.”

Excerpt II:

Inspired by the success of the family enterprise, Richard [Chandler] went to the University of Auckland, where he obtained an accounting degree in 1979 and a master's degree in commercial studies two years later. There his keen intellect and passion for corporate governance blossomed. His master's thesis was a groundbreaking study on corporate board structure and accountability in New Zealand. Richard sent questionnaires to all listed New Zealand companies and 200 individual directors, and concluded that there was a dangerous, widening rift between ownership and control at most quoted companies. The growing clout of institutional shareholders could provide a way to close that rift, the paper added.

“As the son of entrepreneurs, Richard was fascinated by succession issues, the change from direct ownership to indirect ownership and how the boards and managements of formerly private companies that had listed could remain accountable to owners,” says Brian Henshall, founder of the university’s business program and thesis adviser to Richard, the first graduate on whom he had ever bestowed first-class honors.

The thesis had a lasting impact on Chandler’s approach to investing. In a letter to his former professor in 2004, Chandler wrote, “While I did not know it then, our project was the first sign of what would become my vocation, a passion to see capital managed by the most competent, so that companies and countries could enjoy sustainable prosperity.”

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.