Grahamian Value Week in Review ― October 23, 2020

"An investment in knowledge pays the best interest."

― Benjamin Franklin

PART ONE.

WEEK IN REVIEW

PART TWO.

WEEKEND READING

PART THREE.

WEEKEND LISTENING

In the past week —

No new businesses have been added to the Grahamian Value list of companies.

One Grahamian Value listed company reported quarter ended June 30 financials, the details of which are noted below.

We’ve noticed additional interesting developments at three Grahamian Value listed companies.

BRIEF OVERVIEW —

As many readers will likely notice, this is our second consecutive week with no new additions to the GV | United States company list. We continue to keep a close watch on Securities and Exchange Commission filing activity; this weekly update notes several company-specific developments.

While this weekly communication typically explores fresh Grahamian Value companies, we will momentarily focus our attention on uniquely talented fund managers. We proudly introduce Buyside Viewpoints in this issue, which is a distillation of professional perspective presented with full permission of the highlighted thought leader.

Finally, this issue introduces a new “Weekend Listening” section. We are amazed by the depth and breadth of audio material available online — we’re excited to curate exceptional content for your listening enjoyment.

I. WEEK IN REVIEW

Updated Financials: Universal Stainless & Alloy Products, Inc.

Universal Stainless & Alloy Products, Inc. released financials for the quarter ending September 30, 2020 on October 21, 2020. The company reported a net loss of $7 million, or $0.79 per share on $37.4 million in revenues. Notably, the cost of goods sold ($41.86 million) exceeded revenues this quarter, for a negative gross profit during the third quarter.

From a balance sheet standpoint, Universal Stainless has very little cash on hand which has been typical for the business. Net current asset value (unadjusted) per share has fallen slightly since the second quarter, currently at $63 million, or $6.90 per share — made up of $58,000 in cash, plus $26.4 million in receivables, plus $121 million in inventory, plus $4.8 million in other current assets; less $34 million in current liabilities, less $43.9 million in long-term debt (including a $10 million Paycheck Protection Program loan), less $7.6 million in deferred taxes, less $3.7 million in other long-term liabilities; divided among 9,124,011 shares outstanding.

For the quarter ended June 30, 2020 (per the 10-Q filed July 29, 2020) net current asset value (unadjusted) was roughly $67 million or about $7.30 per share, with a similar concentration in inventory and receivables.

Newly Disclosed Owner: Dawson Geophysical Company

Wilks Brothers, LLC, an investment management company run by brothers Dan and Farris Wilks of Cisco, Texas, filed an SC 13G form on October 19, 2020 detailing their 7.7% stake in Dawson Geophysical stock. For further reference, we explored Dawson Geophysical on September 18, 2020 with a brief update on October 2, 2020.

New Shelf Registration: Gulf Island Fabrication, Inc.

Gulf Island Fabrication has filed a Form S-3 Registration Statement on October 20, 2020 for securities across the capital stack, including common stock, preferred shares, debt, and warrants, among others. This may allow Gulf Island to raise as much as $200 million in future capital through various means, but for now the significance of this filing remains opaque.

New Option Grant: Rubicon Technology, Inc.

Timothy Brog, Rubicon Technology’s CEO, filed a Form 4 on October 20, 2020 disclosing his grant of 17,280 shares under Rubicon’s bonus plan. Net of tax withholdings, Mr. Brog now owns 87,000 shares of Rubicon Technology. For further reference, we explored Rubicon Technology on September 18, 2020.

(Full Disclosure: the co-editors are personal shareholders in Dawson Geophysical Co., Gulf Island Fabrication, Inc., and Rubicon Technology.)

II. WEEKEND READING

Important Message for All Readers: The public equities explored below are thinly-traded and not listed on any major exchange. Particular prudence is warranted, personal diligence is always strongly advised.The following is a guest contribution by the President and Portfolio Manager of Bossert Capital, a value-oriented investment firm based in Minneapolis, Minnesota. Alex Bossert is a longtime Grahamian Value reader and generously shared with the co-editors his perspective on a situation that is meaningfully smaller in market capitalization than standard Bossert Capital positions, yet is likely a familiar name among (especially) veteran deep value enthusiasts. The co-editors, with the author’s permission, are proud to share the situational overview below with a message that Mr. Bossert welcomes private feedback from fellow Grahamian Value readers who share a similar personal passion for exploring the overlooked and ignored, of all sizes, in global public markets.

Buyside Viewpoint: A Turnaround That is Turning — Solitron Devices

Solitron is a mission critical supplier to the aerospace and defense industry and their components are used in quite a few major government military programs. The present management team took over in 2016. After a 4 year turnaround effort our view is that Solitron is at an inflection point.

In the first half of FY 2021 Solitron had estimated net income of $737,500 (using the middle of the range mentioned in the company’s press release). On an annualized basis this is $1,475,000 in net income. We believe this level of earnings is sustainable and that earnings will grow from this level in the years ahead. Solitron currently has a market cap of about $6 million and has $2.9 million of cash and securities ($800,000 is a PPP loan), per this corporate update. At recent prices, Solitron is trading for less than 4x our view of current earnings power, and less than 2x earnings net of cash — assuming the PPP loan is forgiven. At 8x current earnings plus cash the stock is worth in excess of $7.00 per share.

Sales have grown by $4 million over the past four years. We think it is likely they will replicate that same level of growth over the next four years driven by their new silicon carbide products. We also think the next $4 million of sales growth will be easier now that management has the operational problems fixed. In an optimistic case, we think in four years Solitron could be at $15 million in sales. We believe a 20% EBIT margin is achievable which results in $3 million in net income (there are no cash taxes due to significant NOLs). With these optimistic longer-term results, at a 10x earning valuation plus balance sheet cash, the stock would be worth nearly $20.

Co-Editors’ Note —

Bossert Capital owns 8.6% of Solitron per this 13-G filing. Shared with permission from Bossert Capital. Alex Bossert can be reached directly at alex@bossertcapital.com.

As of the time of this writing, the co-editors do not own shares of Solitron. Please see important disclaimers at the end of this communication.

Background Detail —

Solitron was the subject of an activist campaign launched by Tim Eriksen of Eriksen Capital Management in 2015, focusing on a corporate history of poor governance, undervaluation, and bad capital allocation. A proxy was filed on July 17, 2015 outlining a plan for improving corporate governance and key strategic steps towards maximizing the value of the company for shareholders. Eriksen Capital Management’s nominees were subsequently elected to the board of directors and Tim Eriksen was subsequently appointed the company’s CEO. Mr. Eriksen and Eriksen Capital Management are further featured below.

The following is a guest contribution by the Managing Partner of Cedar Creek Partners, a value-oriented private partnership based in Lynden, Washington. Tim Eriksen is founder of Eriksen Capital Management — the management company of Cedar Creek Partners. Additionally, as detailed above, Mr. Eriksen serves of CEO of Solitron. Cedar Creek Partners focuses on small and micro-cap equities that fly under the radar of larger funds.

Buyside Viewpoint: Best SPAC Play We Know Of — Pendrell Corporation

Pendrell (PCOA) is an interesting company we purchased shares in during the second quarter. It is controlled by Craig McCaw. In our second quarter letter we gave an overview of Pendrell’s history. A significant event occurred in the third quarter that we want to update you on. Before that, we will briefly walk through the valuation when we purchased.

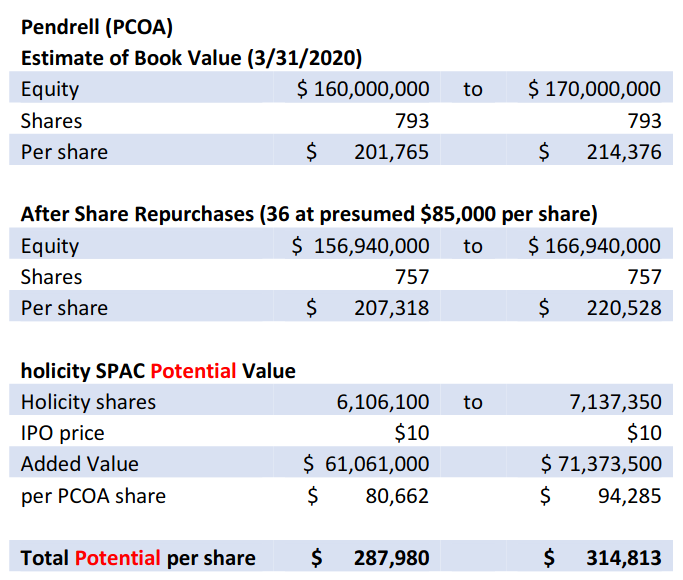

Pendrell’s last publicly filed annual report for the year ended December 31, 2017 showed equity of $199 million, with $184 million of cash and $20 million of receivables, and, adjusted for subsequent reverse splits, a total share count of 968 shares. By spring of 2020 we knew there were only 793 shares outstanding. Our estimate of book value, which we believed was mostly cash and investments, was $160 to $170 million, or $200,000 to $215,000 per share. We had not seen any mention of an acquisition on the company’s website, so we acted on the assumption that the balance sheet was still mostly cash and investments. In May we purchased shares for $75,000 per share, which was less than 40% of our estimate of book value. We assumed minimal cash burn of a few million dollars per year.

Subsequent to our purchase we saw on otcmarkets.com that the share count as of May 31, 2020 was down to 757 shares. We confirmed this amount with Pendrell. We don’t know if Pendrell had been one of the buyers at $75,000 to $85,000 per share or not, but if so, that was a great deal for shareholders when book value was over $200,000 per share.

Then things got even more exciting than just a simple deep value play. A fellow fund manager informed us that Pendrell was sponsoring a special purpose acquisition company (SPAC). The company, named Holicity Inc. (HOL) sold 27.5 million shares for $10 each. A SPAC, or blank check company, is a company created and funded with cash that then seeks to find an acquisition. Once the SPAC finds one it is presented to shareholders for approval. Shareholders who do not like the acquisition can choose to get their original investment back with interest, if any has been earned.

What is interesting is how SPAC’s are structured and that Pendrell shareholders get to participate. The sponsor of the SPAC gets an incredible deal. The sponsor gets what are called “founder’s shares.” Instead of the normal IPO price of say $10 per share, the sponsor pays pennies. It is assumed the sponsor is getting paid to source the acquisition and make a smart deal. For the founders shares to retain full allotment an attractive deal must be presented, which results in a minimal number of shares choosing to have their investment refunded. Obviously due to the low price for founder’s shares, it is by far the most lucrative piece in a SPAC. Pendrell is the first time we had seen a way for the public to participate on the opportunity for founders shares in a SPAC.

Pendrell’s SPAC, Holicity, sold 27.5 million shares to the public for $10 each. Pendrell, as the sponsor, received roughly 8 million shares for $25,000 total, or roughly 3 cents per share. Pendrell distributed about 800,000 of the shares to directors and management of Holicity but over 7 million are still owned by Pendrell. If Holicity fails to complete an acquisition the shares are forfeited, but if they do, they should initially be worth $10 per share, or over $71 million to Pendrell. That works out to over $94,000 per Pendrell share. In addition, Pendrell purchased 5.5 million warrants with a $11.50 strike price for $7 million.

The current bid and ask for Pendrell is $110,000 and $149,000. We believe the odds are favorable that Holicity makes an acquisition, and that eventually Pendrell’s shares can trade at 80 to 100% of book value. If they do, the fund will have a 3 to 4x return on our investment. If they can make an attractive acquisition, the warrants could be in the money making our Pendrell shares worth even more. Recent examples of successful SPAC’s are Nikola (NKLA), WillScot Mobile Mini Holdings (WSC), Virgin Galactic (SPCE), and Restaurant Brands (QSR). We think the “free option” Pendrell shareholders are getting via Holicity is a rare opportunity for a low risk/high reward opportunity that due to Pendrell’s unusually high share price and lack of public financials has not been discovered by the market.

Co-Editors’ Note —

The above excerpt was originally written on October 13, 2020 and is shared with full permission from Eriksen Capital Management. Tim Eriksen can be reached directly at tim@eriksencapital.com.

At of the time of this writing, the co-editors do not own shares of Pendrell. Please see important disclaimers at the end of this communication.

III. WEEKEND LISTENING

Courtesy of Masters in Business, hosted by Barry Ritholtz (twitter): Joel Greenblatt (Managing Principal and Co-Chief Investment Officer, Gotham Asset Management) discusses his latest book, Common Sense: The Investor's Guide to Equality, Opportunity, and Growth with Bloomberg Opinion columnist Barry Ritholtz of Ritholtz Wealth Management.

A full transcript can be accessed here.

Courtesy of The Memo by Howard Marks: Howard Marks (Co-Chairman, Oaktree Capital Management), in his latest memo, discusses the unusual characteristics of this year’s economy; the impact of Covid-related monetary and fiscal policy actions on today’s markets; and the possible ramifications of the Fed/Treasury’s rescue efforts.

A full transcript can be accessed here.

Courtesy of PenderFund: John Mihaljevic (Chairman, MOI Global) discusses value investing, the history of MOI Global, technology businesses and small and micro-cap investing with David Barr, President and Portfolio Manager of Pender.

Podcast episode notes can be accessed here.

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.