Grahamian Value Week in Review ― October 30, 2020

“That’s one of the beauties of the business that Charlie and I are in, is that everything is cumulative. The stuff I learned when I was 20 is useful today. Not in necessarily the same way and not necessarily every day. But it’s useful.”

― Warren Buffett (2001)

PART ONE.

WEEK IN REVIEW

PART TWO.

A VIEW FROM THE CO-EDITORS

PART THREE.

WEEKEND READING

PART FOUR.

WEEKEND LISTENING

In the past week —

One familiar business has been re-added to the Grahamian Value list of companies.

We’ve noticed interesting developments at three Grahamian Value listed companies.

BRIEF OVERVIEW —

As many readers will likely notice, this is our third consecutive week with no material change in the list of GV | United States companies. NOW Inc. is back on the list and, by far, the largest showing of a single sector on the GV | United States list is energy (and related companies).

I. WEEK IN REVIEW

Updated Financials: Dawson Geophysical Company

Dawson Geophysical reported a net loss of $7.8 million for the quarter ended September 30, 2020 — inclusive of $4.1 million in non-cash depreciation and amortization charges. Capital expenditures were reduced to just $58,000.

Notably, over $21 million of prior quarter accounts receivable converted to cash, thereby drastically reducing Dawson’s credit exposure and resulting in a $51 million cash balance as of September 30, 2020 — composed of $45 million in cash and equivalents, $5 million in restricted cash (to secure a line of credit), and $583,000 in short-term investments.

CEO Stephen Jumper (see: GV Compendium, October 16, 2020) discussed the difficulty Dawson faces in the industry down-cycle —

“The current downturn in the oil and gas industry is one of the most difficult periods I have experienced in my 35 years in the industry. Reduced commodity prices triggered by the COVID-19 pandemic and an oversupplied oil market continue to weigh on our operations and will likely remain so through the end of the year and into 2021. That said, we are well situated to withstand the current downturn as our cost cutting measures, strong balance sheet and investment in state-of-the art equipment in years past has positioned us for a strong recovery once the market turns. We continue to believe as E&P companies focus on returns as opposed to growth, the use of high resolution seismic data should play an important role in achieving that goal. As noted in our previous press releases, I want to thank all of our hard-working employees and our valued clients and shareholders during these challenging times.” (Press release dated October 29, 2020)

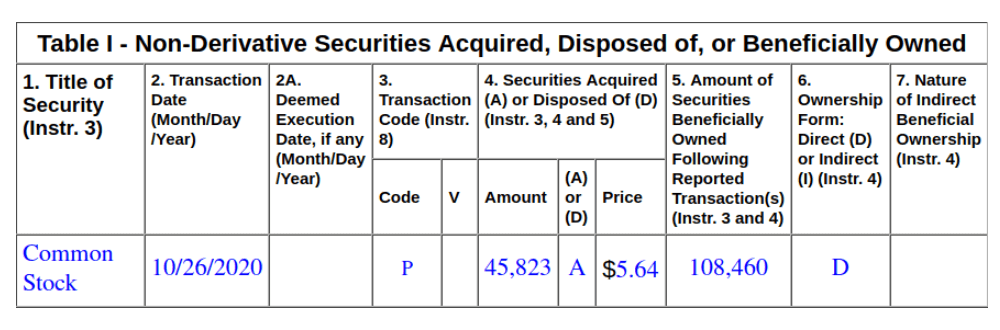

Insider Purchase: Universal Stainless & Alloy Products, Inc.

Christopher M. Zimmer, EVP and Chief Commercial Officer of Universal Stainless & Alloy Products, reported his purchase of 45,823 shares in the open market on October 26, 2020 at an average price of $5.64 on a Form 4 filed the same day with the SEC. This brings his total personal holdings to 108,460 shares of Universal Stainless stock.

Updated Financials: Mammoth Energy Services Inc.

Mammoth Energy Services Inc. reported a GAAP net profit of $3.4 million (on revenues of $70.5 million) for the quarter ending September 30, 2020 via this October 29, 2020 press release. The delineation below of capital expenditures by operating division is particularly noteworthy —

II. A VIEW FROM THE CO-EDITORS

Net-Nets as a “Canary in a Coal Mine”

We believe that monitoring areas of the market (and identifying times of turmoil) that present stocks that trade at extraordinarily depressed valuations (such as discounts to net current asset value) may provide broader insight into pockets of dislocation and opportunity. While oil and gas-related equities experience blanket decimation, it is likely that some quality businesses within the space are unjustifiably oversold. Said otherwise — amidst ubiquitous bath water, we’re intrigued to seek a proverbial baby.

One area within the energy sector about which we’ve become familiar is the seismic data space; i.e., companies that (typically) provide geophysical imaging data to exploration and production (E&P) companies. One such company is Dawson Geophysical, which has been discussed at length in past updates (September 18, 2020, October 2, 2020, and October 23, 2020). In our assessment, seismic data businesses appear more asset-light than peers in the E&P space, more flexible in their required capital expenditures, and have some degree of separation from direct consumer demand for oil and gas products. Per our September 18 update, we particularly admire Bob Robotti of Robotti & Co. and note his deep expertise in cyclical energy businesses. Mr. Robotti serves as Chairman of the Board at Pulse Seismic and we encourage readers to explore the links below for further seismic industry background:

One can argue that profitable investment in a good house in a bad neighborhood is easier said than done. While oil and gas stocks are subject to fire sale valuations, busted oil and gas businesses may face serious structural issues, ranging from impending regulatory risks to collapsing demand and ensuing credit shocks. This time might be different. (Co-editors’ note: this is an interesting read).

An “Air Pocket” of Interest — Geospace Technology Corporation

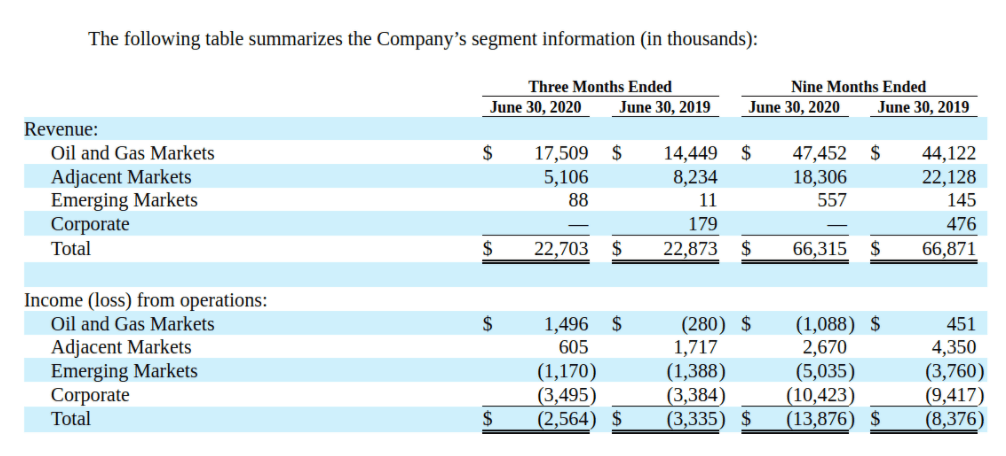

As we observe what, only in hindsight, will prove either a compression or an erosion of equity value across the energy sector, we are particularly intrigued by Geospace Technology Corporation. Geospace is a manufacturer and supplier of seismic data equipment, and counts Dawson Geophysical among their customers. While Geospace serves seismic data companies (such as Dawson) through its primary Oil and Gas Markets segment, Geospace operates two additional business lines:

Adjacent Markets — which sells seismic products that have applications outside of Oil and Gas, and;

Emerging Markets — comprised of an acquisition of Quantum Technology Sciences, Inc., a security and surveillance company.

As a supplier to the seismic data sector, Geospace’s Oil and Gas Markets segment is subject to the cyclicality of this end market. As with other seismic related firms, Geospace has demonstrated a remarkable flexibility in reducing capital expenditures as warranted — so as to later expand capital spending under more favorable industry conditions. During the quarterly period ended June 30, 2020, Geospace generated $3.9 million of EBITDA on $22.7 million in revenue while slashing capital expenditure to effectively zero. The company’s Adjacent Markets segment (which sells similar seismic equipment) makes up roughly one-third of Geospace’s revenues, typically commands a higher gross margin, and provides a bit of a buffer from energy-related cyclicality.

Geospace’s Emerging Markets segment, created from the 2018 acquisition of Quantum, won a $10 million contract from the U.S. Customs and Border Protection U.S. Border Patrol for an unspecified technology solution in April 2020. Quantum’s primary offering is “a proprietary detection system called SADAR®, which detects, locates and tracks items of interest in real-time... used for border and perimeter security surveillance, cross-border tunneling detection and other products targeted at movement monitoring, intrusion detection and situational awareness.” (Form 10-K filed November 22, 2019)

Additionally, as detailed in Geospace’s Form 10-Q filed on August 7, 2020 (with emphasis added), “Quantum has primarily focused on product development activities, and the marketing of its technologies to government agencies and other end users. We expect Quantum to incur operating losses until revenue from its recently awarded contract is recognized, most of which is not expected to occur until the first quarter of fiscal year 2021.”

Since the acquisition of Quantum, Geospace has invested roughly $5 million annually to further develop and market the operating segment’s product line — an entirely discretionary line item. We view the Emerging Markets operating segment as an embedded VentureCo that is self-financed by the company’s pre-existing business units; the VentureCo component of Geospace is a distinct business with radically different prospects than LegacyCo. Importantly, Geospace’s leadership can scale up (or down) incremental VentureCo investment as is prudently warranted. While the value of VentureCo is intangible and challenging from the outside to assess — the option value is real.

As of June 30, 2020, Geospace’s balance sheet reported $30.5 million of net plant, property and equipment. In June 2019, the company sold a property (to the occupying tenant) for $8.6 million which had been carried on Geospace’s balance sheet at $1.6 million. It is likely that Geospace’s real estate holdings (slide 21) are worth substantially more than their carrying value — as detailed in this terrific write-up by Value Investors Club member “militiaman” on July 15, 2020.

Sansone Capital Management (founded by Christopher R. Sansone) and Nierenberg Investment Management (founded by David Nierenberg) have each filed a Schedule 13D — on February 12, 2020 and May 26, 2020, respectively. Subsequently, Geospace announced “several immediate and upcoming changes to its Board of Director’s and the implementation of certain governance measures” — on August 11, 2020.

Geospace’s tangible book value is roughly twice the company’s recent market capitalization; from the outside, the company’s asset base seems larger than may be operationally necessary, a detail we presume the aforementioned equity owners will strategically assess and address. Additionally of note, during the nine month period ended July 30, 2020: (1) Geospace generated roughly $66 million of revenue; (2) reported a $12.8 million of loss before taxes; and, (3) allocated $12.5 million towards research and development — all of which was accounted for as an operating expense. From arm’s length, it would seem reasonable to surmise that either this roughly $17 million annualized corporate outlay will substantively contribute to future earnings power or in due time will cease.

Attribution to “militiaman” on Value Investors Club —

Value Investors Club member “militiaman” explored Geospace on July 15, 2020 and his original work heavily influences our above perspective. We encourage readers to explore his original write-up for a more detailed (and more eloquently expressed) situational assessment.

(Full Disclosure: the co-editors are personal shareholders in Dawson Geophysical Company, Geospace Technologies Corporation, and NOW Inc.)

III. WEEKEND READING

Get Real: Using Real Options in Security Analysis, by Michael J. Mauboussin (June 23, 1999)

The End of Accounting and the Path Forward for Investors and Managers, by Baruch Lev and Feng Gu (June 2, 2016)

An innovative new valuation framework with truly useful economic indicators: The End of Accounting shows how the ubiquitous financial reports have become useless in capital market decisions and lays out an actionable alternative.

Above: Baruch Lev in conversation with Martin Fridson (more) at Stern School of Business on July 14, 2016.

IV. WEEKEND LISTENING

Courtesy of The Wall Street Journal & Gimlet: The U.S. oil industry is going through a deep downturn, and oil towns in West Texas are feeling the pain. WSJ’s Christopher M. Matthews explains what it looks like when a town goes from boom to bust in record time, and what it could mean for the rest of the economy.

Courtesy of The Grant Williams Podcast: Bill Fleckenstein (twitter) and Grant Williams (twitter) welcome historian, journalist and author Edward Chancellor to The End Game. Edward’s remarkable book, Devil Take The Hindmost, chronicles three centuries of bubbles and manias and, in this wonderful conversation, he shares his thoughts on how and why they end, the historical parallels previous bubbles share with today and the likely problems the world faces at it moves through The End Game.

Additionally Recommended:

Capital Returns: Investing Through the Capital Cycle (November 25, 2015)

Above: Edward Chancellor in conversation with Jacob Taylor (more) at Five Good Questions on March 24, 2016.

ABOUT GRAHAMIAN VALUE

Founded in 2020, Grahamian Value is a open resource dedicated to the art of intelligent investing.

The co-editors of Grahamian Value, as of the date of this communication, may individually own shares of companies mentioned herein. The publishers do not receive compensation from the companies and people covered in Grahamian Value for such coverage. This communication is for informational purposes only. This is not intended to be investment advice. Seek a duly licensed professional for investment advice.